ICICI Bank 2014 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F24

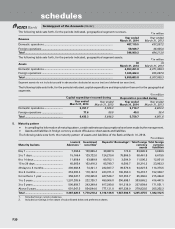

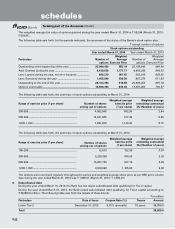

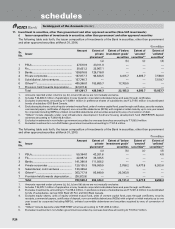

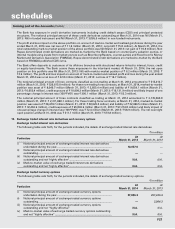

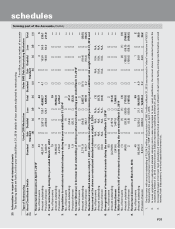

11. Investment in securities, other than government and other approved securities (Non-SLR investments)

i) Issuer composition of investments in securities, other than government and other approved securities

The following table sets forth, the issuer composition of investments of the Bank in securities, other than government

and other approved securities at March 31, 2014.

` in million

Sr.

No. Issuer

Amount Extent of

private

placement2

Extent of ‘below

investment grade’

securities

Extent of

‘unrated’

securities3,4

Extent of

‘unlisted’

securities4

(a) (b) (c) (d)

1 PSUs ....................................................... 27,510.9 23,311.0 — — —

2 FIs ........................................................... 25,421.2 23,007.1 — — —

3 Banks ...................................................... 139,816.8 129,718.0 — — —

4 Private corporates ................................. 107,977.7 96,624.5 4,415.7 4,385.7 7,538.0

5 Subsidiaries/ Joint ventures ................. 127,746.7 — — — 7,519.7

6 Others5,6,7 ................................................ 405,366.0 153,885.7 17,769.5 — —

7 Provision held towards depreciation .... (22,537.6) — — — —

Total 811,301.7 426,546.3 22,185.2 4,385.7 15,057.7

1. Amounts reported under columns (a), (b), (c) and (d) above are not mutually exclusive.

2. Includes ` 44,898.3 million of application money towards corporate bonds/debentures and pass through certificates.

3. Excludes investments, amounting to ` 4,809.1 million in preference shares of subsidiaries and ` 2,710.6 million in subordinated

bonds of subsidiary ICICI Bank Canada.

4. Excludes equity shares, units of equity-oriented mutual fund, units of venture capital fund, pass through certificates, security receipts,

commercial papers, certificates of deposit, non-convertible debentures (NCDs) with original or initial maturity up to one year issued

by corporate (including NBFCs), unlisted convertible debentures and securities acquired by way of conversion of debt.

5. “Others” include deposits under rural infrastructure development fund/rural housing development fund (RIDF/RHDF) deposit

schemes amounting to ` 248,192.8 million.

6. Excludes investments in non-Indian government securities by overseas branches amounting to ` 7,095.9 million

7. Excludes investments in non-SLR Indian government securities amounting to ` 167.8 million.

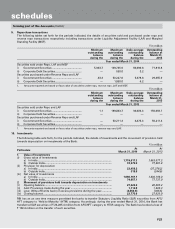

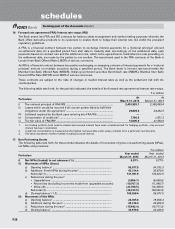

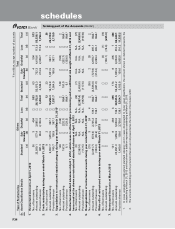

The following table sets forth, the issuer composition of investments of the Bank in securities, other than government

and other approved securities at March 31, 2013.

` in million

Sr.

No. Issuer

Amount Extent of

private

placement3

Extent of ‘below

investment grade’

securities

Extent of

‘unrated’

securities4,5

Extent of

‘unlisted’

securities4,5

(a) (b) (c) (d)

1 PSUs ...................................................... 59,394.0 42,261.8 — — 4.8

2 FIs .......................................................... 42,987.8 33,325.5 — — —

3 Banks ..................................................... 141,396.9 111,926.2 — — —

4 Private corporates ................................ 129,135.3 109,980.9 2,788.2 5,477.8 8,263.6

5 Subsidiaries/ Joint ventures ................ 133,339.4 — — — —

6 Others5,6 ................................................ 303,717.9 95,849.9 20,343.0 — —

7 Provision held towards depreciation ... (26,372.9) — — — —

Total 783,598.4 393,344.3 23,131.2 5,477.8 8,268.4

1. Amounts reported under columns (a), (b), (c) and (d) above are not mutually exclusive.

2. Includes ` 26,075.7 million of application money towards corporate bonds/debentures and pass through certificates.

3. Excludes investments, amounting to ` 4,738.4 million, in preference shares of subsidiaries and ` 5,381.2 million in subordinated

bonds of subsidiaries, namely ICICI Bank UK PLC and ICICI Bank Canada.

4. Excludes equity shares, units of equity-oriented mutual fund, units of venture capital fund, pass through certificates, security

receipts, commercial papers, certificates of deposit, non-convertible debentures (NCDs) with original or initial maturity up to one

year issued by corporate (including NBFCs), unlisted convertible debentures and securities acquired by way of conversion of

debt.

5. “Others” include deposits under RIDF/RHDF schemes amounting to ` 201,983.2 million.

6. Excludes investments in non-Indian government securities by overseas branches amounting to ` 6,574.7 million.

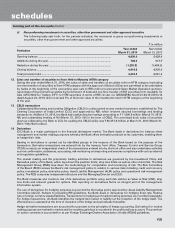

forming part of the Accounts (Contd.)

schedules