ICICI Bank 2014 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2013-2014 59

Inflation, measured by the Wholesale Price Index (WPI), increased from 4.8% in April 2013 to 7.5% in

November 2013, and then eased to 5.7% in March 2014. Average WPI inflation during fiscal 2014 was

5.9%, compared to 7.4% average inflation during fiscal 2013. Inflation eased due to a moderation in the

manufactured products segment, where average inflation in fiscal 2014 decreased to 2.9% compared

to 5.4% in fiscal 2013. Fuel inflation remained flat at about 10.0% in fiscal 2014. However, food inflation

increased from an average of 9.9% in fiscal 2013 to 12.8% in fiscal 2014. Retail inflation, measured by the

Consumer Price Index (CPI), remained elevated at above 9.0% levels during the early part of fiscal 2014

and increased to a high of 11.2% in November 2013 before easing to 8.3% in March 2014. CPI inflation

largely followed the trend in food inflation. Core CPI inflation, excluding food and fuel, remained steady

at around 8.0% through fiscal 2014.

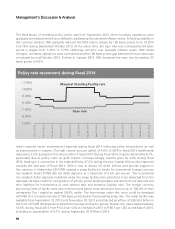

Conduct of monetary policy during fiscal 2014 could be demarcated into three distinct phases. In the

early part of fiscal 2014, considering the easing inflation levels, Reserve Bank of India (RBI) reduced the

repo rate by 25 basis points from 7.50% to 7.25% in May 2013. In the second phase, following the US

Federal Reserve indicating a likely withdrawal of its quantitative easing programme in May 2013, there

was a considerable outflow of portfolio funds from emerging market economies. India saw a significant

outflow of foreign portfolio investments, particularly debt funds, leading to a sharp depreciation in the

rupee. The rupee depreciated by 17.8% against the US dollar between June-August 2013 and touched a

low of ` 68.4 per US dollar on August 28, 2013 as compared to ` 56.5 per US dollar at end-May 2013. In

response to these developments, RBI changed its monetary policy stance. On July 15, 2013, with a view

to stabilise the exchange rate, RBI increased the Marginal Standing Facility (MSF) rate, which is the rate at

which banks borrow funds, in excess of the specified threshold, overnight from RBI against government

securities, by 200 basis points from 8.25% to 10.25% while keeping the repo rate unchanged. The RBI

also fixed the borrowing limit for banks under the Liquidity Adjustment Facility (LAF) at ` 750.00 billion.

Effective July 24, 2013, RBI announced a further reduction in the borrowing limit under LAF to 0.5%

of net demand and time liabilities. In addition, effective July 27, 2013, the minimum daily cash reserve

ratio balance required to be maintained by banks was increased to 99.0% of the stipulated fortnightly

requirement from 70.0% earlier. The immediate impact of these measures on the market was a sharp

increase in wholesale deposit rates and yields on government securities. Considering the impact of these

measures to stabilise the exchange rate, RBI allowed certain adjustments on the investment portfolio

of banks. The measures included increasing the limit for holding government securities in the held-to-

maturity (HTM) category to 24.5% of net demand and time liabilities as against the earlier requirement

of 24.0%, allowing banks to transfer securities from the available-for-sale and held-for-trading categories

to the held-to-maturity category up to 24.5% of demand and time liabilities as a one-time measure at

prices prevailing prior to the announcement of the July 15, 2013 measures, and giving banks the option

to amortise net depreciation on the available-for-sale and held-for-trading portfolio over the remaining

period of fiscal 2014.