ICICI Bank 2014 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.50

Business Overview

50

Business Overview

The Bank’s credit approval authorisation framework is laid down by our Board of Directors. We have

established several levels of credit approval authorities for our corporate banking activities like the Credit

Committee of the Board of Directors, the Committee of Executive Directors, the Committee of Senior

Management, the Committee of Executives (Credit) and the Regional Committee (Credit). The authorisation

framework is risk based with lower rated borrowers and/or larger exposures being escalated to higher

committees. Retail Credit Forums, Small Enterprise Group Forums and Corporate Agriculture Group Forums

have been created for approval of retail loans and credit facilities to small enterprises and agri based

enterprises respectively. Individual executives have been delegated with powers in case of policy based

retail products to approve financial assistance within the exposure limits set by our Board of Directors.

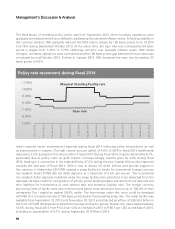

Market Risk: Market risk is the risk whereby movements in market factors such as foreign exchange

rates, interest rates, credit spreads and equity prices reduce our income or the market value of our

portfolios. Exposure to market risk is segregated into two portfolios--trading and structural banking

books. Trading portfolios comprise positions arising from market making activity and trading on our own

account. Market risk on the trading portfolio is assessed and managed through measures such as price

value of one basis point, value-at-risk, stop loss and net overnight open position limits. The structural

banking book comprises the non-trading portfolio which arises from management of our corporate and

retail assets and liabilities, and available for sale and held to maturity positions. The risks associated with

non-trading portfolios are measured through metrices such as duration of equity, earnings at risk and

liquidity gap limits. The limits are stipulated in our Investment Policy, Asset Liability Management Policy

and Derivatives Policy which are reviewed and approved by our Board of Directors.

The Asset Liability Management Committee (ALCO) comprises wholetime Directors and senior

executives. ALCO meets periodically and reviews the Bank’s business profile and its impact on asset

liability management and determines the asset liability management strategy in light of the current and

expected business environment. ALCO reviews the positions of the trading groups and the interest rate

and liquidity gap positions on the banking book. ALCO also sets deposit and benchmark lending rates. The

Market Risk Management Group recommends changes in risk policies and controls and the processes

and methodologies for quantifying and assessing market risks. Risk limits including position limits and

stop loss limits for the trading book are monitored by the Treasury Control and Services Group and

reviewed periodically. Foreign exchange risk is monitored through the net overnight open position limit.

Interest rate risk is measured through the use of re-pricing gap analysis and duration analysis. Interest

rate risk is further monitored through interest rate risk limits approved by ALCO.

The Bank uses various tools for measurement of liquidity risk including the statement of structural

liquidity, dynamic liquidity gap statements, liquidity ratios and stress testing. We maintain diverse sources

of liquidity to facilitate flexibility in meeting funding requirements. Incremental operations in the domestic

market are principally funded by accepting deposits from retail and corporate depositors. The deposits

are augmented by borrowings in the short-term inter-bank market and through the issuance of bonds.

Loan maturities and sale of investments also provide liquidity. Our international branches are primarily

funded by debt capital market issuances, lines of financing from export credit agencies, syndicated loans,

bilateral loans and bank lines, while our international subsidiaries raise deposits in their local markets.

Operational Risk: Operational risk is the risk of loss resulting from inadequate or failed internal processes,

people or systems, or from external events. Operational risk includes legal risk but excludes strategic and

reputational risks. Operational risk is inherent in the Bank’s business activities in both domestic as well

as overseas operations and covers a wide spectrum of issues. Operational risk can result from a variety

of factors, including failure to obtain proper internal authorisations, improperly documented transactions,

failure of operational and information security procedures, computer systems, software or equipment,