ICICI Bank 2014 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2013-2014 79

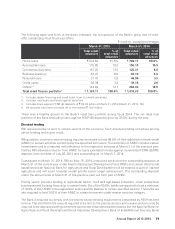

The following table sets forth, at the dates indicated, the composition of the Bank’s gross (net of write-

offs) outstanding retail finance portfolio.

` in billion, except percentages

March 31, 2013 March 31, 2014

Total retail

advances

% of

total retail

advances

Total retail

advances

% of

total retail

advances

Home loans ` 578.63 51.5% ` 709.17 50.0%

Automobile loans 115.85 10.3 155.15 10.9

Commercial business 151.25 13.5 125.31 8.8

Business banking167.41 6.0 83.10 5.9

Personal loans 31.75 2.8 46.90 3.3

Credit cards 36.39 3.2 36.16 2.6

Others2, 3 142.83 12.7 262.44 18.5

Total retail finance portfolio3 ` 1,124.11 100.0% ` 1,418.23 100.0%

1. Includes dealer financing and small ticket loans to small businesses.

2. Includes rural loans and loans against securities.

3. Includes loans against FCNR (B) deposits of ` 65.03 billion at March 31, 2014 (March 31, 2013: Nil).

4. All amounts have been rounded off to the nearest ` 10.0 million.

There was a healthy growth in the Bank’s retail loan portfolio during fiscal 2014. The net retail loan

portfolio of the Bank (excluding loans against FCNR (B) deposits) grew by 23.0% during the year.

Directed lending

RBI requires banks to lend to certain sectors of the economy. Such directed lending comprises priority

sector lending and export credit.

RBI guideline on priority sector lending requires the banks to lend 40.0% of their adjusted net bank credit

(ANBC) to certain activities carried out by the specified borrowers. The definition of ANBC includes certain

investments and is computed with reference to the respective amounts at March 31 of the previous year.

Further, RBI allowed exclusion from ANBC for loans extended in India against incremental FCNR (B)/NRE

deposits from the date of July 26, 2013 and outstanding as on March 7, 2014.

Subsequent to March 31, 2014, RBI on May 15, 2014, instructed banks that the outstanding deposits at

March 31 of the current year under Rural Infrastructure Development Fund (RIDF) and certain other funds

established with National Bank for Agriculture and Rural Development will be treated as part of indirect

agriculture and will count towards overall priority sector target achievement. The outstanding deposits

under the above funds at March 31 of the previous year will form part of ANBC.

Priority sector includes lending to agricultural sector, food and agri-based industries, small enterprises/

businesses and housing finance up to certain limits. Out of the 40.0%, banks are required to lend a minimum

of 18.0% of their ANBC to the agriculture sector and the balance to certain specified sectors. The banks are

also required to lend 10.0% of their ANBC to certain borrowers under weaker sections category.

The Bank is required to comply with the priority sector lending requirements prescribed by RBI from time

to time. The shortfall in the amount required to be lent to the priority sectors and weaker sections may be

required to be deposited with government sponsored Indian development banks like the National Bank for

Agriculture and Rural Development/Small Industries Development Bank of India/National Housing Bank/