ICICI Bank 2014 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion & Analysis

60

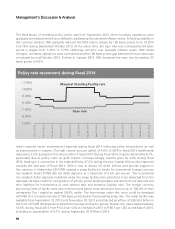

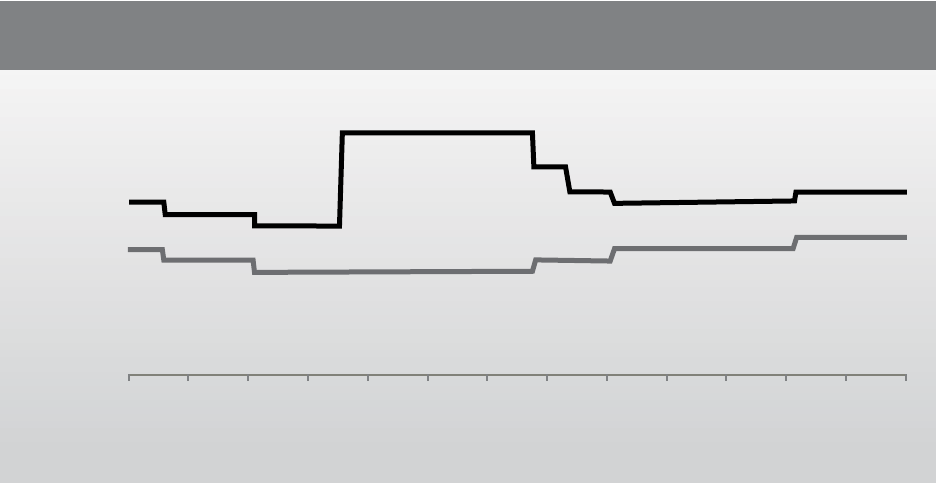

The third phase of monetary policy action was from September 2013 when monetary operations were

gradually normalised while focus shifted to addressing the elevated inflation levels. Following stability in

the currency markets, RBI gradually reduced the MSF rate in stages by 150 basis points from 10.25%

to 8.75% during September-October 2013. At the same time, the repo rate was increased by 50 basis

points in stages from 7.25% to 7.75% reflecting concerns over elevated inflation levels. With these

changes, monetary operations were normalised and the 100 basis points gap between the two rates was

re-instated by end-October 2013. Further, in January 2014, RBI increased the repo rate by another 25

basis points to 8.0%.

India’s external sector environment improved during fiscal 2014 following policy interventions as well

as improvement in exports. The high current account deficit of 4.8% of GDP in fiscal 2013 significantly

reduced to 2.2% during the first nine months of fiscal 2014. During fiscal 2014, imports declined by 8.1%,

particularly due to policy curbs on gold imports. Correspondingly, exports grew by 4.0% during fiscal

2014, leading to a contraction in the trade deficit by 27.2% during the year. Capital inflows also improved

towards the later part of fiscal 2014. With a view to attract US dollar inflows and provide support to

the currency, in September 2013 RBI opened a swap facility for banks for incremental foreign currency

non-resident (bank) (FCNR (B)) US dollar deposits at a fixed rate of 3.5% per annum. The incremental

non-resident dollar deposits mobilised under the swap facility were permitted to be deducted from the

adjusted net bank credit for computation of priority sector lending targets and also from net demand and

time liabilities for maintenance of cash reserve ratio and statutory liquidity ratio. The foreign currency

borrowing limits of banks were also enhanced and banks were allowed to borrow up to 100.0% of their

unimpaired Tier I capital as against 50.0% earlier. The borrowings under this route could be swapped

with RBI at a concessional rate of 100 basis points below the prevailing swap rate. The swap facility was

available from September 10, 2013 until November 30, 2013 and attracted an inflow of US$ 34.3 billion in

the form of FCNR (B) deposits and bank borrowings during the period. Overall, the rupee depreciated by

10.5% during fiscal 2014 from ` 54.4 per US$ at end-March 2013 to ` 60.1 per US$ at end-March 2014,

including an appreciation of 9.7% during September 2013-March 2014.

Management’s Discussion & Analysis

Policy rate movement during fiscal 2014

11.00%

10.00%

9. 00%

8. 00%

7. 00%

6. 00%

5 00%

Marginal Standing Facility rate

Repo rate

Mar 1, 2013

Mar 31, 2013

Apr 30, 2013

Jul 29, 2013

Aug 28, 2013

Sep 27, 2013

Oct 27, 2013

Nov 26, 2013

Dec 26, 2013

Jan 25, 2014

Feb 24, 2014

Mar 31, 2014

Jun 29, 2013

May 30, 2013