ICICI Bank 2014 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F90

forming part of the Consolidated Accounts (Contd.)

schedules

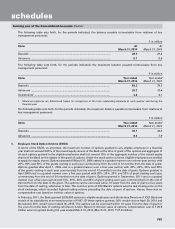

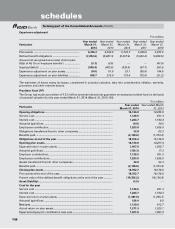

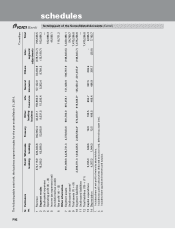

` in million

Particulars At

March 31, 2014

At

March 31, 2013

Deferred tax asset

Provision for bad and doubtful debts ................................................................. 28,595.5 28,150.5

Capital loss ........................................................................................................... 49.6 63.1

Others .................................................................................................................. 2,790.2 2,871.8

Total deferred tax asset ...................................................................................... 31,435.3 31,085.4

Deferred tax liability

Special reserve deduction1 ................................................................................. 17,234.9 —

Depreciation on fixed assets ............................................................................... 5,242.4 4,744.2

Others .................................................................................................................. 37.5 18.5

Total deferred tax liability .................................................................................. 22,514.8 4,762.7

Net deferred tax asset/(liability) pertaining to foreign branches/foreign

subsidiaries ......................................................................................................... 377.3 483.3

Total net deferred tax asset/(liability) ............................................................... 9,297.8 26,806.0

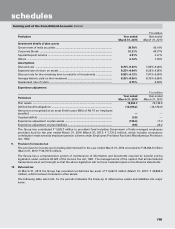

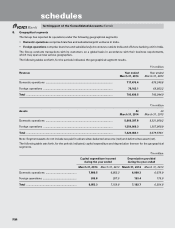

1. The Bank creates Special Reserve through appropriation of profits, in order to avail tax deduction as per Section 36(1)(viii) of the

Income Tax Act, 1961. The Reserve Bank of India, through its circular dated December 20, 2013, advised banks to create a deferred

tax liability (DTL) on the amount outstanding in Special Reserve, as a matter of prudence. In accordance with these RBI guidelines,

the Bank has created a DTL of ` 14,192.3 million on Special Reserve outstanding at March 31, 2013, by reducing the reserves.

Further, the tax expense for the year ended March 31, 2014 is higher by ` 3,042.6 million due to creation of DTL on amount

appropriated to Special Reserve for the year ended March 31, 2014.

At March 31, 2014, ICICI Prudential Life Insurance Company has created deferred tax asset on carry forward unabsorbed

losses amounting to Nil (March 31, 2013: ` 12.8 million) which can be set off against future taxable income.

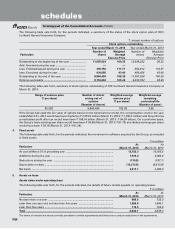

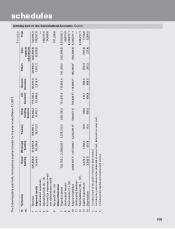

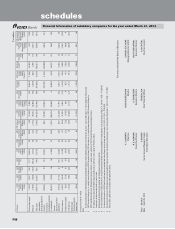

11. Information about business and geographical segments

A. Business segments for the year ended March 31, 2014

The business segments of the Group have been presented as follows:

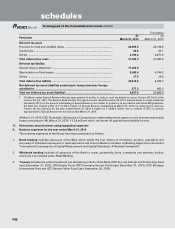

1. Retail banking includes exposures of the Bank which satisfy the four criteria of orientation, product, granularity and

low value of individual exposures for retail exposures laid down in Basel Committee on Banking Supervision document

“International Convergence of Capital Measurement and Capital Standards: A Revised Framework”.

2. Wholesale banking includes all advances of the Bank to trusts, partnership firms, companies and statutory bodies,

which are not included under Retail Banking.

3. Treasury includes the entire investment and derivative portfolio of the Bank, ICICI Eco-net Internet and Technology Fund

(upto December 31, 2013), ICICI Equity Fund, ICICI Emerging Sectors Fund (upto December 31, 2013), ICICI Strategic

Investments Fund and ICICI Venture Value Fund (upto September 30, 2013).