ICICI Bank 2014 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2013-2014 43

online shopping. This card brings unparalleled safety for online transactions by embedding an alpha-numeric

LCD screen, a 12-button touch keypad and an in-built battery to generate dynamic one time passcodes.

Various premium and feature-rich debit cards have also been introduced. The Bank also recognises the

growing importance of electronic, chip-based and near-field communication (NFC) based payments and

has institutionalised the first-ever inter-operable electronic toll collection solution in India on the Mumbai-

Ahmedabad highway.

ICICI Bank has also worked towards making access to loans easier for customers. Customers can check their

loan eligibility and print sanction letters instantly using the “Express Loans” programme. Prospective home

buyers can view all housing projects approved by ICICI Bank on an interactive map. ICICI Bank customers can

now also apply for multiple products in a single form without the need for multiple documentation, reducing

processing delays.

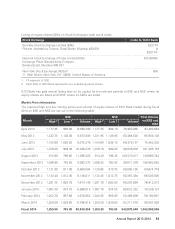

The Bank has expanded its network to 3,753 branches and 11,315 ATMs. National Payments Corporation of

India (NPCI) has awarded ICICI Bank with the ‘Best ATM Operational Excellence Award’ in the Private Sector-

Foreign Bank category for the third consecutive year. ICICI Bank was also named the ‘Best Retail Bank in India’

by The Asian Banker. A number of the Bank’s initiatives have been recognised by many reputed forums such

as Indian Banks Association (IBA), Celent, Institute of Development & Research in Banking Technology (IDRBT)

and others. The Bank received awards for ‘Most Innovative Bank’ and ‘Most Innovative use of Multi-Channel

Infrastructure’ at the Indian Banks Association’s BANCON Innovation Awards 2013.

All these initiatives have helped the Bank achieve robust growth in its retail business. The Bank’s mortgage

loan and auto loan disbursements grew by 26.8% and 51.7%, respectively, in fiscal 2014. The Bank has also

focused on growth in its business banking portfolio, which comprises lending to small businesses though the

Bank’s extensive branch network. The Bank achieved healthy increase in the overall retail portfolio by 23.0% to

` 1,320.11 billion. The Bank continues to see strong momentum in the acquisition of retail deposit customers

and robust growth in the retail deposit base. The Bank’s savings account deposits grew by 15.7% in fiscal

2014, to ` 991.33 billion.

Small & Medium Enterprises

Small & Medium Enterprises (SMEs) are an important constituent of India’s economy and have become

a thrust area for future growth. A strong SME sector is fundamental to building a resilient and dynamic

corporate sector.

At ICICI Bank, we offer a full suite of banking products and solutions to SMEs for meeting their business

and growth requirements. Our experience of partnering with SMEs has enabled us to develop non-

traditional techniques of assessing credit risk unique to them. We also offer supply chain financing