ICICI Bank 2014 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2013-2014 75

Regulatory capital

The Bank was subject to Basel II capital adequacy guidelines stipulated by the Reserve Bank of India (RBI)

till March 31, 2013. During fiscal 2013, RBI issued final Basel III guidelines, applicable with effect from

April 1, 2013 in a phased manner through till March 31, 2019 as per the transitional arrangement provided

by RBI for Basel III implementation. The Basel III rules on capital consist of measures on improving the

quality, consistency and transparency of capital, enhancing risk coverage, introducing a supplementary

leverage ratio, reducing pro-cyclicality and promoting counter-cyclical buffers and addressing systemic

risk and inter-connectedness.

At March 31, 2014, the Bank is required to maintain minimum Common Equity Tier-1 (CET1) capital ratio

of 5.00%, minimum Tier-1 capital ratio of 6.50% and minimum total capital ratio of 9.00%. Under Pillar

1 of RBI guidelines on Basel III, the Bank follows the standardised approach for measurement of credit

risk, standardised duration method for measurement of market risk and basic indicator approach for

measurement of operational risk.

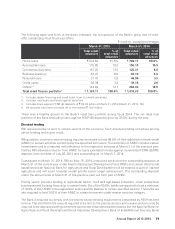

The following table sets forth the capital adequacy ratios computed in accordance with Basel III guidelines

of RBI at March 31, 2014.

` in billion, except percentages

Basel III At March 31, 2014

CET1 capital ` 637.38

Tier-1 capital 637.38

Tier-2 capital 245.13

Total capital 882.51

Credit Risk — Risk Weighted Assets (RWA) 4,409.13

On balance sheet 3,353.64

Off balance sheet 1,055.49

Market Risk — RWA 265.74

Operational Risk — RWA 311.16

Total RWA ` 4,986.03

Total capital adequacy ratio 17.70%

CET1 capital adequacy ratio 12.78%

Tier-1 capital adequacy ratio 12.78%

Tier-2 capital adequacy ratio 4.92%

1. All amounts have been rounded off to the nearest ` 10.0 million.

The above table shows that the Bank is well capitalised to meet Basel III capital requirements with Tier-1 capital

adequacy ratio of 12.78% as against the current requirement of 6.50% and total capital adequacy ratio of

17.70% as against the current requirement of 9.00%.

At March 31, 2014, consolidated Tier-1 capital adequacy ratio was 13.11% as against the current requirement

of 6.50% and total consolidated capital adequacy ratio was 18.34% as against the current requirement

of 9.00%.