ICICI Bank 2014 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F17

forming part of the Accounts (Contd.)

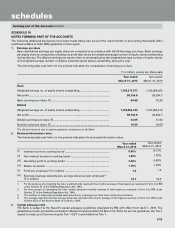

SCHEDULE 18

NOTES FORMING PART OF THE ACCOUNTS

The following additional disclosures have been made taking into account the requirements of Accounting Standards (ASs)

and Reserve Bank of India (RBI) guidelines in this regard.

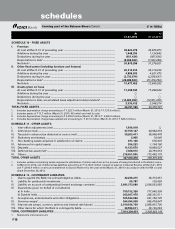

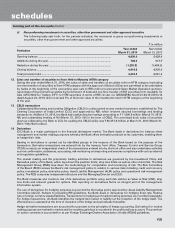

1. Earnings per share

Basic and diluted earnings per equity share are computed in accordance with AS 20–Earnings per share. Basic earnings

per equity share is computed by dividing net profit after tax by the weighted average number of equity shares outstanding

during the year. The diluted earnings per equity share is computed using the weighted average number of equity shares

and weighted average number of dilutive potential equity shares outstanding during the year.

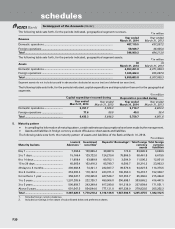

The following table sets forth, for the periods indicated, the computation of earnings per share.

` in million, except per share data

Year ended

March 31, 2014

Year ended

March 31, 2013

Basic

Weighted average no. of equity shares outstanding ......................................... 1,154,317,577 1,153,066,422

Net profit .............................................................................................................. 98,104.8 83,254.7

Basic earnings per share (`) ................................................................................ 84.99 72.20

Diluted

Weighted average no. of equity shares outstanding ......................................... 1,158,893,790 1,157,455,610

Net profit .............................................................................................................. 98,104.8 83,254.7

Diluted earnings per share (`) ............................................................................. 84.65 71.93

Nominal value per share (`) ................................................................................ 10.00 10.00

The dilutive impact is due to options granted to employees by the Bank.

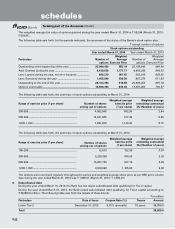

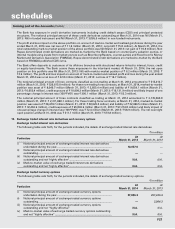

2. Business/information ratios

The following table sets forth, for the periods indicated, the business/information ratios.

Year ended

March 31, 2014

Year ended

March 31, 2013

(i) Interest income to working funds1 ............................................................. 8.00% 8.17%

(ii) Non-interest income to working funds1 .................................................... 1.89% 1.70%

(iii) Operating profit to working funds1 ............................................................ 3.00% 2.69%

(iv) Return on assets2 ........................................................................................ 1.78% 1.70%

(v) Profit per employee3 (` in million) ............................................................ 1.4 1.4

(vi) Business (average deposits plus average advances) per employee3,4

(` in million) 74.7 73.5

1. For the purpose of computing the ratio, working funds represent the monthly average of total assets as reported in Form X to RBI

under Section 27 of the Banking Regulation Act, 1949.

2. For the purpose of computing the ratio, assets represent monthly average of total assets as reported in Form X to RBI under

Section 27 of the Banking Regulation Act, 1949.

3. The number of employees includes sales executives, employees on fixed term contracts and interns.

4. The average deposits and the average advances represent the simple average of the figures reported in Form A to RBI under

Section 42(2) of the Reserve Bank of India Act, 1934.

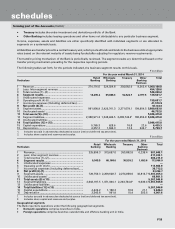

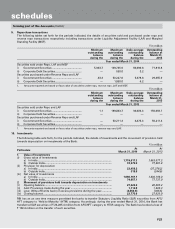

3. Capital adequacy ratio

The Bank is subject to the Basel III capital adequacy guidelines stipulated by RBI with effect from April 1, 2013. The

guidelines provide a transition schedule for Basel III implementation till March 31, 2019. As per the guidelines, the Tier-1

capital is made up of Common Equity Tier-1 (CET1) and Additional Tier-1.

schedules