ICICI Bank 2014 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F80

forming part of the Consolidated Accounts (Contd.)

schedules

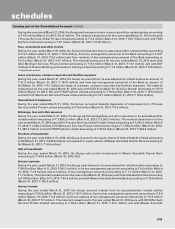

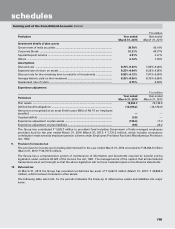

Gramin Bank amounting to ` 7.5 million (March 31, 2013: ` 47.2 million).

Dividend paid

During the year ended March 31, 2014, the Bank paid dividend to its key management personnel amounting to ` 8.1

million (March 31, 2013: ` 6.7 million). The dividend paid during the year ended March 31, 2014 to Chanda Kochhar

was ` 6.6 million (March 31, 2013: ` 5.1 million), to N. S. Kannan was ` 1.5 million (March 31, 2013: ` 1.2 million) and to

K. Ramkumar was Nil (March 31, 2013: ` 0.4 million).

Remuneration to whole-time directors

Remuneration paid to the whole-time directors of the Bank during the year ended March 31, 2014 was ` 168.7 million

(March 31, 2013: ` 154.9 million). The remuneration paid for the year ended March 31, 2014 to Chanda Kochhar was

` 58.3 million (March 31, 2013: ` 54.2 million), to N. S. Kannan was ` 33.6 million (March 31, 2013: ` 32.2 million), to

K. Ramkumar was ` 46.9 million (March 31, 2013: ` 42.7 million) and to Rajiv Sabharwal was ` 29.9 million (March 31,

2013: ` 25.8 million).

Sale of fixed assets

During the year ended March 31, 2014, the Group sold fixed assets to its associates/other related entities amounting to

` 2.7 million (March 31, 2013: Nil) and to its key management personnel amounting to Nil (March 31, 2013: ` 0.7 million).

The material transactions for the year ended March 31, 2014 were with India Infradebt Limited amounting to ` 2.7 million

(March 31, 2013: Nil) and with K. Ramkumar amounting to Nil (March 31, 2013: ` 0.7 million).

Donation

During the year ended March 31, 2014, the Group has given donation to ICICI Foundation for Inclusive Growth amounting

to ` 257.6 million (March 31, 2013: ` 104.0 million).

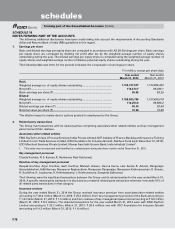

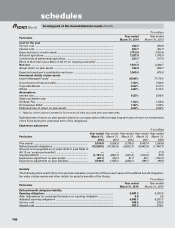

Related party balances

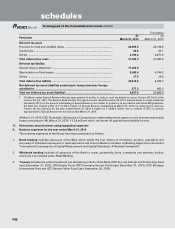

The following table sets forth, for the periods indicated, the balance payable to/receivable from its associates/other

related entities:

` in million

Items At

March 31, 2014

At

March 31, 2013

Deposits with the Group ................................................................................... 4,231.9 5,084.8

Advances ........................................................................................................... 2.4 305.5

Investments of the Group in related parties ..................................................... 1,903.6 1,903.6

Investments of related parties in the Group ..................................................... 15.0 15.0

Payables ............................................................................................................. 381.0 1,279.2

Guarantees issued by the Group ...................................................................... 0.1 0.1

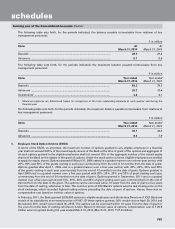

The following table sets forth, for the periods indicated, the balance payable to/receivable from key management

personnel:

` in million, except number of shares

Items At

March 31, 2014

At

March 31, 2013

Deposits .............................................................................................................. 51.0 60.5

Advances ............................................................................................................ 28.0 5.7

Investments ........................................................................................................ 4.2 4.1

Employee Stock Options Outstanding (Numbers) ........................................... 3,760,000 3,172,500

Employee Stock Options Exercised1 ................................................................. 0.4 0.5

1. During the year ended March 31, 2014, 37,500 employee stock options were exercised by the key management personnel of the

Bank (March 31, 2013: 54,000), which have been reported at face value.