ICICI Bank 2014 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Annual Report 2013-2014 83

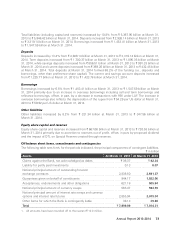

Wholesale banking segment

Profit before tax of the wholesale banking segment decreased from ` 66.19 billion in fiscal 2013 to

` 65.88 billion in fiscal 2014 primarily due to increase in provisions offset, in part, by increase in net

interest income and non-interest income.

Net interest income increased by 10.1% from ` 68.46 billion in fiscal 2013 to ` 75.39 billion in fiscal 2014

primarily due to growth in loan portfolio in the wholesale banking segment. Non-interest income increased

by 6.1% from ` 38.22 billion in fiscal 2013 to ` 40.57 billion in fiscal 2014, primarily due to increase in

lending linked fee income. Provisions were higher primarily due to increase in additions to NPAs and

restructured loans in the SME and corporate loan portfolio resulting in a higher provision requirement.

Treasury segment

Profit before tax of the treasury segment increased from ` 36.54 billion in fiscal 2013 to ` 52.52 billion in

fiscal 2014 primarily due to increase in non-interest income. The non-interest income was higher primarily

due to higher level of dividend income from subsidiaries, realised gain on government securities portfolio

and other fixed income positions, exchange gain on repatriation of retained earnings from overseas

branches and foreign exchange trading gains.

Other banking segment

Profit before tax of other banking segment in fiscal 2014 was ` 2.98 billion compared to profit of ` 1.69

billion in fiscal 2013 primarily due to higher non-interest income and lower provisions.

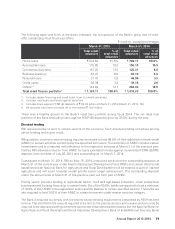

CONSOLIDATED FINANCIALS AS PER INDIAN GAAP

The consolidated profit after tax including the results of operations of ICICI Bank’s subsidiaries and other

consolidating entities increased by 15.0% from ` 96.04 billion in fiscal 2013 to ` 110.41 billion in fiscal

2014 primarily due to increase in the profit of ICICI Bank and ICICI Lombard General Insurance Company

Limited (ICICI General). The consolidated return on average equity increased from 14.66% in fiscal 2013

to 14.91% in fiscal 2014.

Profit after tax of ICICI Prudential Life Insurance Company Limited (ICICI Life) increased from ` 14.96 billion

in fiscal 2013 to ` 15.67 billion in fiscal 2014 due to lower expenses. Commission expenses decreased

primarily on account of change in product mix from conventional products to linked products as linked

products have lower commission rates. New business annual premium equivalent decreased by 2.5%

from ` 35.32 billion during fiscal 2013 to ` 34.44 billion during fiscal 2014.

Profit after tax of ICICI General increased from ` 3.06 billion in fiscal 2013 to ` 5.11 billion in fiscal 2014

primary due to higher premium income, investment income and commission income offset, in part, by

increase in claims and benefits paid and operating expenses.

Profit after tax of ICICI Bank Canada increased from ` 2.37 billion (CAD 43.6 million) in fiscal 2013 to ` 2.77

billion (CAD 48.3 million) in fiscal 2014 primarily due to increase in net interest income and fee income.

The increase was offset, in part, by increase in provisions and operating expenses. The increase in net

interest income was due to increase in net interest margin.

Profit after tax of ICICI Bank UK Plc increased from ` 0.78 billion (US$ 14.4 million) in fiscal 2013 to ` 1.52

billion (US$ 25.2 million) in fiscal 2014 primarily due to increase in net interest income and fee income

and lower provisions. The increase in net interest income was on account of increase in average volume

of interest-earning assets.