ICICI Bank 2014 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion & Analysis

72

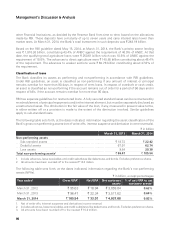

Cash and cash equivalents

Cash and cash equivalents include cash in hand and balances with RBI and other banks, including money

at call and short notice. Cash and cash equivalents increased from ` 414.18 billion at March 31, 2013 to

` 415.30 billion at March 31, 2014 primarily due to increase in money at call and short notice and balances

with RBI, offset, in part, by a decrease in deposits with other banks and term money lent.

Investments

Total investments increased by 3.3% from ` 1,713.94 billion at March 31, 2013 to ` 1,770.22 billion at

March 31, 2014, primarily due to an increase in RIDF and other related investments made pursuant to

shortfall in directed lending requirements by ` 46.21 billion, pass through certificates by ` 42.01 billion

and investment in government securities by ` 27.89 billion. Corporate bonds and debentures decreased

by ` 53.58 billion and commercial paper and certificates of deposit decreased by ` 16.25 billion at March

31, 2014 compared to March 31, 2013.

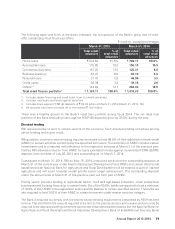

Advances

Net advances increased by 16.7% from ` 2,902.49 billion at March 31, 2013 to ` 3,387.03 billion at

March 31, 2014 primarily due to increase in retail advances and overseas corporate advances. Net retail

advances increased by 23.0% from ` 1,073.59 billion at March 31, 2013 to ` 1,320.11 billion at March 31,

2014. Net advances of overseas branches (including offshore banking unit), in dollar terms, increased by

11.1% from US$ 13.5 billion at March 31, 2013 to US$ 15.0 billion at March 31, 2014. However, due to

rupee depreciation from ` 54.29 per US dollar at March 31, 2013 to ` 59.92 per US dollar at March 31,

2014, net advances of overseas branches (including offshore banking unit), in rupee terms, increased by

22.3% from ` 733.57 billion at March 31, 2013 to ` 896.96 billion at March 31, 2014.

Fixed and other assets

Fixed assets (net block) increased marginally from ` 46.47 billion at March 31, 2013 to ` 46.78 billion at

March 31, 2014. Other assets increased from ` 290.87 billion at March 31, 2013 to ` 327.09 billion at

March 31, 2014.

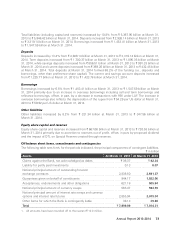

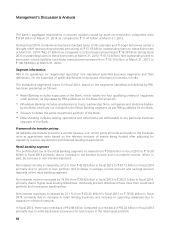

Liabilities

The following table sets forth, at the dates indicated, the principal components of liabilities (including

capital and reserves). ` in billion, except percentages

Liabilities At March 31, 2013 At March 31, 2014 % change

Equity share capital ` 11.54 ` 11.55 0.1%

Reserves 655.52 720.58 9.9

Deposits 2,926.14 3,319.14 13.4

- Savings deposits 856.51 991.33 15.7

- Current deposits 369.26 432.45 17.1

- Term deposits 1,700.37 1,895.35 11.5

Borrowings (excluding subordinated debt and

preference share capital) 1,053.29 1,142.24 8.4

- Domestic 402.98 333.38 (17.3)

- Overseas branches 650.31 808.86 24.4

Subordinated debt (included in Tier-1 and

Tier-2 capital)1396.62 401.85 1.3

- Domestic 378.21 381.51 0.9

- Overseas branches 18.41 20.34 10.5

Preference share capital13.50 3.50 0.0

Other liabilities 321.34 347.56 8.2

Total liabilities ` 5,367.95 ` 5,946.42 10.8%

1. Included in Schedule 4 - “Borrowings” of the balance sheet.

2. All amounts have been rounded off to the nearest ` 10.0 million.

Management’s Discussion & Analysis