ICICI Bank 2014 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196

|

|

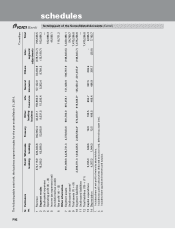

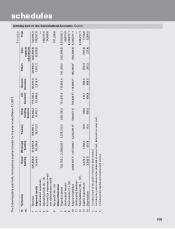

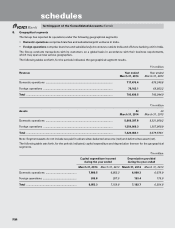

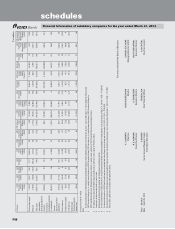

F91

forming part of the Consolidated Accounts (Contd.)

schedules

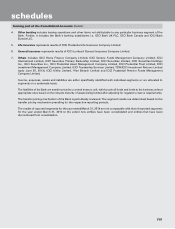

4. Other banking includes leasing operations and other items not attributable to any particular business segment of the

Bank. Further, it includes the Bank’s banking subsidiaries i.e. ICICI Bank UK PLC, ICICI Bank Canada and ICICI Bank

Eurasia LLC.

5. Life insurance represents results of ICICI Prudential Life Insurance Company Limited.

6. General insurance represents results of ICICI Lombard General Insurance Company Limited.

7. Others includes ICICI Home Finance Company Limited, ICICI Venture Funds Management Company Limited, ICICI

International Limited, ICICI Securities Primary Dealership Limited, ICICI Securities Limited, ICICI Securities Holdings

Inc., ICICI Securities Inc., ICICI Prudential Asset Management Company Limited, ICICI Prudential Trust Limited, ICICI

Investment Management Company Limited, ICICI Trusteeship Services Limited, TCW/ICICI Investment Partners Limited

(upto June 30, 2013), ICICI Kinfra Limited, I-Ven Biotech Limited and ICICI Prudential Pension Funds Management

Company Limited.

Income, expenses, assets and liabilities are either specifically identified with individual segments or are allocated to

segments on a systematic basis.

The liabilities of the Bank are transfer priced to a central treasury unit, which pools all funds and lends to the business units at

appropriate rates based on the relevant maturity of assets being funded after adjusting for regulatory reserve requirements.

The transfer pricing mechanism of the Bank is periodically reviewed. The segment results are determined based on the

transfer pricing mechanism prevailing for the respective reporting periods.

The results of reported segments for the year ended March 31, 2014 are not comparable with that of reported segments

for the year ended March 31, 2013 to the extent new entities have been consolidated and entities that have been

discontinued from consolidation.