ICICI Bank 2014 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F45

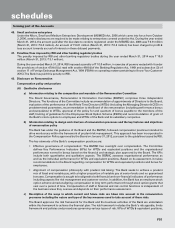

Relatives of key management personnel

Deepak Kochhar, Arjun Kochhar, Aarti Kochhar, Mahesh Advani, Varuna Karna, Late Sunita R. Advani, Rangarajan

Kumudalakshmi, Aditi Kannan, Narayanan Raghunathan, Narayanan Rangarajan, Narayanan Krishnamachari, R. Shyam,

R. Suchithra, K. Jayakumar, R. Krishnaswamy, J. Krishnaswamy, Sangeeta Sabharwal.

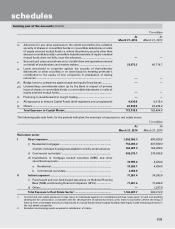

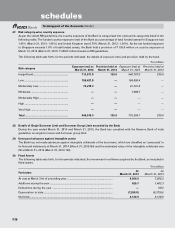

The following were the significant transactions between the Bank and its related parties for the year ended March 31,

2014. A specific related party transaction is disclosed as a material related party transaction wherever it exceeds 10% of

all related party transactions in that category.

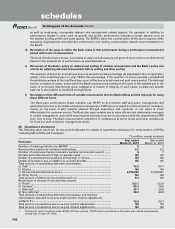

Insurance services

During the year ended March 31, 2014, the Bank paid insurance premium to insurance subsidiaries amounting to `

1,072.6 million (March 31, 2013: ` 969.6 million). The material transactions for the year ended March 31, 2014 were

payment of insurance premium to ICICI Lombard General Insurance Company Limited amounting to ` 978.5 million

(March 31, 2013: ` 871.8 million) and to ICICI Prudential Life Insurance Company Limited amounting to ` 94.1 million

(March 31, 2013: ` 97.8 million).

During the year ended March 31, 2014, the Bank’s insurance claims (including the claims received by the Bank on

behalf of key management personnel) from the insurance subsidiaries amounted to ` 396.6 million (March 31, 2013: `

503.6 million). The material transactions for the year ended March 31, 2014 were with ICICI Lombard General Insurance

Company Limited amounting to ` 326.7 million (March 31, 2013: ` 444.3 million) and with ICICI Prudential Life Insurance

Company Limited amounting to ` 69.9 million (March 31, 2013: ` 59.3 million).

Fees and commission income

During the year ended March 31, 2014, the Bank received fees from its subsidiaries amounting to ` 5,880.4 million (March

31, 2013: ` 4,726.6 million), from its associates/joint ventures/other related entities amounting to ` 9.7 million (March 31,

2013: ` 13.9 million) and from relatives of key management personnel amounting to ` 0.1 million (March 31, 2013: ` 0.1

million). The material transactions for the year ended March 31, 2014 were with ICICI Prudential Life Insurance Company

Limited amounting to ` 4,876.0 million (March 31, 2013: ` 3,860.1 million) and with ICICI Lombard General Insurance

Company Limited amounting to ` 597.9 million (March 31, 2013: ` 516.6 million).

During the year ended March 31, 2014, the Bank received commission on bank guarantees from its subsidiaries

amounting to ` 48.1 million (March 31, 2013: ` 41.8 million). The material transactions for the year ended March 31, 2014

were with ICICI Bank UK PLC amounting to ` 39.1 million (March 31, 2013: ` 35.1 million) and with ICICI Bank Eurasia

Limited Liability Company amounting to ` 7.7 million (March 31, 2013: ` 5.6 million).

Lease of premises, common corporate and facilities expenses

During the year ended March 31, 2014, the Bank recovered from its subsidiaries an amount of ` 1,257.9 million (March

31, 2013: ` 1,099.3 million), from its associates/joint ventures/other related entities an amount of ` 72.3 million (March 31,

2013: ` 147.9 million) and from its key management personnel amounting to Nil (March 31, 2013: ` 0.1 million) for lease

of premises, common corporate and facilities expenses. The material transactions for the year ended March 31, 2014

were with ICICI Securities Limited amounting to ` 288.4 million (March 31, 2013: ` 229.1 million), ICICI Home Finance

Company Limited amounting to ` 276.1 million (March 31, 2013: ` 273.3 million), ICICI Prudential Life Insurance Company

Limited amounting to ` 224.2 million (March 31, 2013: ` 164.0 million), ICICI Bank UK PLC amounting to ` 180.8 million

(March 31, 2013: ` 151.2 million), ICICI Lombard General Insurance Company Limited amounting to ` 159.7 million

(March 31, 2013: ` 143.6 million) and with ICICI Merchant Services Private Limited amounting to ` 0.7 million (March 31,

2013: ` 147.9 million).

Secondment of employees

During the year ended March 31, 2014, the Bank recovered towards deputation of employees from its subsidiaries an

amount of ` 71.5 million (March 31, 2013: ` 52.2 million) and from its associates/joint ventures/other related entities an

amount of ` 6.6 million (March 31, 2013: ` 6.6 million). The material transactions for the year ended March 31, 2014 were

with ICICI Investment Management Company Limited amounting to ` 38.9 million (March 31, 2013: ` 35.6 million), ICICI

Prudential Life Insurance Company Limited amounting to ` 16.1 million (March 31, 2013: ` 1.0 million), ICICI Securities

Limited amounting to ` 15.4 million (March 31, 2013: ` 14.5 million) and with I-Process Services (India) Private Limited

amounting to ` 6.6 million (March 31, 2013: ` 6.6 million).

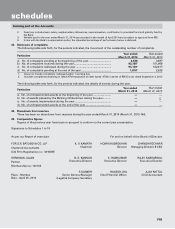

Purchase of investments

During the year ended March 31, 2014, the Bank purchased certain investments from its subsidiaries amounting to `

10,087.0 million (March 31, 2013: ` 23,702.1 million). The material transactions for the year ended March 31, 2014 were

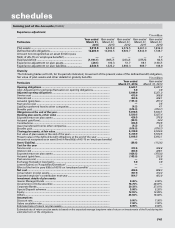

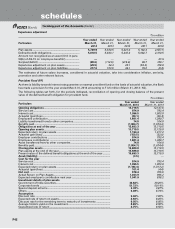

forming part of the Accounts (Contd.)

schedules