ICICI Bank 2014 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F63

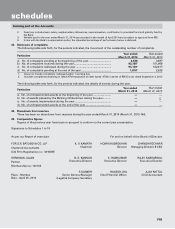

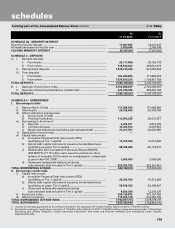

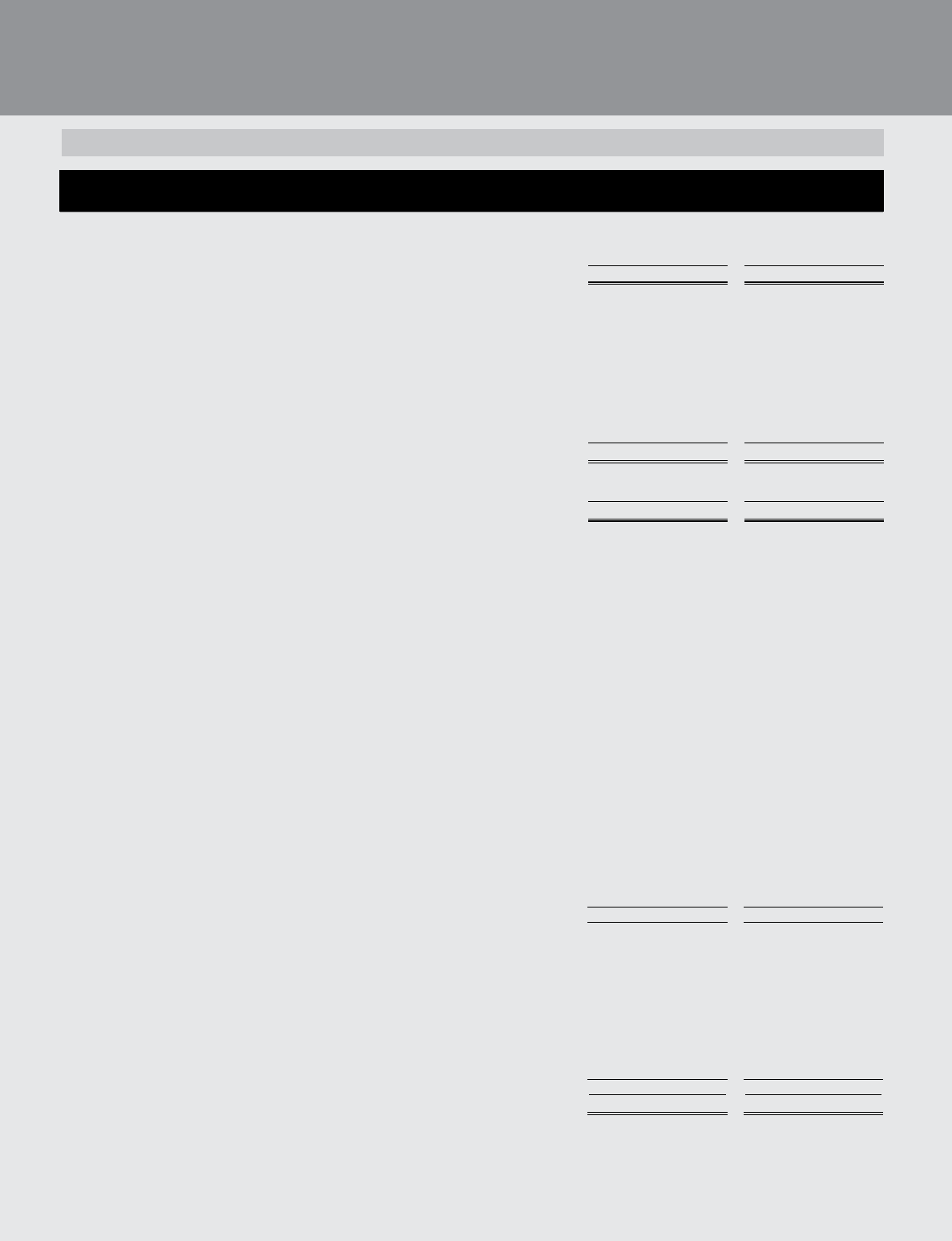

forming part of the Consolidated Balance Sheet (Contd.) (` in ‘000s)

At

31.03.2014

At

31.03.2013

SCHEDULE 2A - MINORITY INTEREST

Opening minority interest ...................................................................................... 17,057,595 14,277,247

Increase/(decrease) during the year ...................................................................... 3,050,046 2,780,348

CLOSING MINORITY INTEREST ........................................................................... 20,107,641 17,057,595

SCHEDULE 3 - DEPOSITS

A. I. Demand deposits

i) From banks ....................................................................................... 25,111,999 20,192,733

ii) From others ...................................................................................... 418,534,442 359,512,610

II. Savings bank deposits ............................................................................ 1,078,310,338 921,659,854

III. Term deposits

i) From banks ....................................................................................... 102,299,809 117,888,455

ii) From others ...................................................................................... 1,970,870,235 1,728,451,705

TOTAL DEPOSITS ................................................................................................... 3,595,126,823 3,147,705,357

B. I. Deposits of branches in India ................................................................. 3,154,088,437 2,743,209,597

II. Deposits of branches/subsidiaries outside India ................................... 441,038,386 404,495,760

TOTAL DEPOSITS ................................................................................................... 3,595,126,823 3,147,705,357

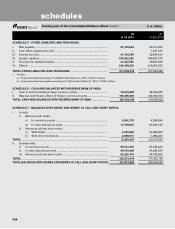

SCHEDULE 4 - BORROWINGS

I. Borrowings in India

i) Reserve Bank of India .............................................................................. 111,388,500 171,688,500

ii) Other banks ............................................................................................. 29,736,455 55,276,764

iii) Other institutions and agencies

a) Government of India ....................................................................... ——

b) Financial institutions ........................................................................ 113,976,226 96,037,351

iv) Borrowings in the form of

a) Deposits ........................................................................................... 3,382,761 3,815,378

b) Commercial paper ........................................................................... 10,324,543 6,093,554

c) Bonds and debentures (excluding subordinated debt) ................. 37,217,701 39,645,665

v) Application money-bonds ........................................................................ ——

vi) Capital instruments

a) Innovative Perpetual Debt Instruments (IPDI)

(qualifying as Tier 1 capital) ............................................................ 13,010,000 13,010,000

b) Hybrid debt capital instruments issued as bonds/debentures

(qualifying as upper Tier 2 capital) ................................................. 98,166,998 98,174,210

c) Redeemable Non-Cumulative Preference Shares (RNCPS)

(350 RNCPS of ` 10 million each issued to preference share

holders of erstwhile ICICI Limited on amalgamation, redeemable

at par on April 20, 2018) .................................................................. 3,500,000 3,500,000

d) Unsecured redeemable debentures/bonds

(subordinated debt included in Tier 2 capital) ................................ 222,079,732 223,261,041

TOTAL BORROWINGS IN INDIA ............................................................................ 642,782,916 710,502,463

II. Borrowings outside India

i) Capital instruments

a) Innovative Perpetual Debt Instruments (IPDI)

(qualifying as Tier 1 capital) ............................................................ 20,336,164 18,413,008

b) Hybrid debt capital instruments issued as bonds/debentures

(qualifying as upper Tier 2 capital) ................................................. 58,918,180 53,348,947

c) Unsecured redeemable debentures/bonds

(subordinated debt included in Tier 2 capital) ............................... 8,939,380 12,224,275

ii) Bonds and notes ...................................................................................... 394,138,872 315,107,768

iii) Other borrowings1 ................................................................................... 710,305,178 619,285,733

TOTAL BORROWINGS OUTSIDE INDIA ............................................................... 1,192,637,774 1,018,379,731

TOTAL BORROWINGS ........................................................................................... 1,835,420,690 1,728,882,194

1. Includes borrowings guaranteed by Government of India for the equivalent of ` 16,353.2 million (March 31, 2013: ` 15,815.0 million).

2. Secured borrowings in I and II above amount to ` 115,542.2 million (March 31, 2013: ` 106,283.5 million) except borrowings under Collateralised

Borrowing and Lending Obligation, market repurchase transactions with banks and financial institutions and transactions under Liquidity

Adjustment Facility.

schedules