ICICI Bank 2014 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F34

forming part of the Accounts (Contd.)

schedules

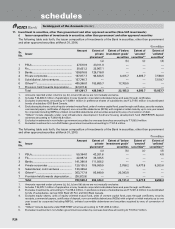

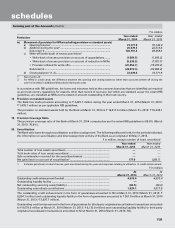

` in million, except number of accounts

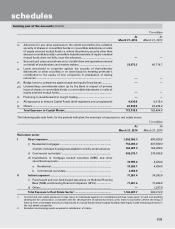

Type of Restructuring Others Total

Sr.

no.

Asset Classification Details Standard

(a)

Sub-

Standard

(b)

Doubtful

(c)

Loss

(d)

Total

(e)

Standard

(a)

Sub-

Standard

(b)

Doubtful

(c)

Loss

(d)

Total

(e)

1. Restructured Accounts at April 1, 2012

No. of borrowers 36 3 494 —533 63 4 504 2 573

Amount outstanding 22,509.1 577.4 3,085.5 —26,172.0 50,073.3 732.3 4,618.6 113.9 55,538.1

Provision thereon 981.3 86.6 2,136.9 —3,204.8 4,528.9 214.9 2,936.7 113.9 7,794.4

2. Fresh restructuring during year ended March 31, 2013

No. of borrowers 9 2 1 —12 23 2 1 —26

Amount outstanding 8,057.7 1,851.5 387.1 —10,296.3 18,139.8 1,851.5 387.1 —20,378.4

Provision thereon 745.7 158.9 387.1 —1,291.7 1,564.9 158.9 387.1 —2,110.9

3. Upgradations to restructured standard category during year ended March 31, 20131

No. of borrowers 148 —(148) — — 148 —(148) — —

Amount outstanding 197.0 —(232.7) —N.A.2197.0 —(232.7) —N.A.2

Provision thereon 6.1 —(129.5) —N.A.26.1 —(129.5) —N.A.2

4. Restructured standard advances at April 1, 2012, which cease to attract higher provisioning and/or additional risk weight at March 31, 2013 and

hence need not be shown as restructured standard advances at April 1, 2013

No. of borrowers (6) N.A. N.A. N.A. (6) (7) N.A. N.A. N.A. (7)

Amount outstanding (2,397.4) N.A. N.A. N.A. (2,397.4) (2,458.6) N.A. N.A. N.A. (2,458.6)

Provision thereon (117.5) N.A. N.A. N.A. (117.5) (117.6) N.A. N.A. N.A. (117.6)

5. Downgradations of restructured accounts during year ended March 31, 20131

No. of borrowers (31) 3 24 4 —(36) 2 28 6 —

Amount outstanding (2,481.7) (573.0) 2,745.2 138.1 N.A.2(4,536.0) (727.9) 4,878.7 295.1 N.A.2

Provision thereon (303.4) (85.9) 1,108.9 138.1 N.A.2(481.0) (214.2) 2,280.4 295.1 N.A.2

6. Write-offs of restructured accounts during year ended March 31, 2013

No. of borrowers — — — — — — — (2) (1) (3)

Amount outstanding — — — — — — — (158.1) (76.9) (235.0)

7. Restructured Accounts at March 2013

No. of borrowers 141 8 283 4 436 174 8 295 7 484

Amount outstanding 22,891.0 1,855.9 5,650.6 138.1 30,535.6 58,252.2 1,855.9 9,004.8 316.2 69,429.1

Provision thereon 1,469.0 159.6 3,738.0 138.1 5,504.7 5,103.8 159.6 5,955.6 316.2 11,535.2

1. In cases upgraded to restructured standard category and in cases downgraded to lower asset classification, the amount shown as deleted represents the

outstanding at March 31, 2012 and that shown in addition represents outstanding at March 31, 2013.

2. The amounts outstanding and the provision thereon are not presented as the number of borrowers is Nil.