ICICI Bank 2014 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

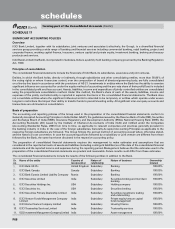

F61

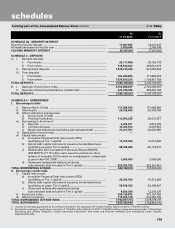

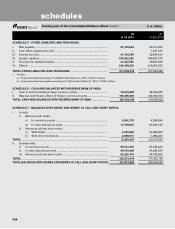

schedules

forming part of the Consolidated Balance Sheet (` in ‘000s)

At

31.03.2014

At

31.03.2013

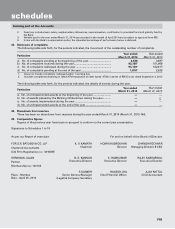

SCHEDULE 1 - CAPITAL

Authorised capital

1,275,000,000 equity shares of ` 10 each

(March 31, 2013: 1,275,000,000 equity shares of ` 10 each) ............................... 12,750,000 12,750,000

15,000,000 shares of ` 100 each

(March 31, 2013: 15,000,000 shares of ` 100 each)1 ............................................ 1,500,000 1,500,000

350 preference shares of ` 10 million each

(March 31, 2013: 350 preference shares of ` 10 million each)2 ........................... 3,500,000 3,500,000

Equity share capital

Issued, subscribed and paid-up capital

1,153,581,715 equity shares of ` 10 each

(March 31, 2013: 1,152,714,442 equity shares) .................................................... 11,535,817 11,527,144

Add: 1,405,540 equity shares of ` 10 each (March 31, 2013: 867,273 equity shares)

issued pursuant to exercise of employee stock options ................................................ 14,055 8,673

Less: 154,486 equity shares of ` 10 each forfeited (March 31, 2013: Nil) ............ 1,545 —

11,548,327 11,535,817

Less: Calls unpaid .................................................................................................. — (225)

Add: 266,089 equity shares of ` 10 each forfeited

(March 31, 2013: 111,603 equity shares) ............................................................. 2,119 770

TOTAL CAPITAL ..................................................................................................... 11,550,446 11,536,362

1. These shares will be of such class and with such rights, privileges, conditions or restrictions as may be determined by

the Bank in accordance with the Articles of Association of the Bank and subject to the legislative provisions in force for

the time being in that behalf.

2. Pursuant to RBI circular the issued and paid-up preference shares are grouped under Schedule 4- “Borrowings”.

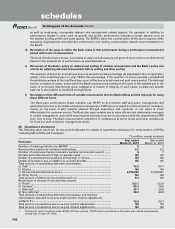

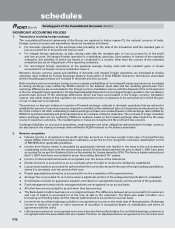

SCHEDULE 2 - RESERVES AND SURPLUS

I. Statutory reserve

Opening balance ............................................................................................. 110,736,519 89,916,519

Additions during the year ............................................................................... 24,530,000 20,820,000

Deductions during the year ............................................................................ ——

Closing balance ............................................................................................... 135,266,519 110,736,519

II. Special reserve

Opening balance ............................................................................................. 48,612,700 40,571,700

Additions during the year ............................................................................... 9,446,000 8,041,000

Deductions during the year ............................................................................ ——

Closing balance ............................................................................................... 58,058,700 48,612,700

III. Securities premium

Opening balance ............................................................................................ 314,492,354 313,975,852

Additions during the year1 .............................................................................. 1,045,396 516,502

Deductions during the year ............................................................................ ——

Closing balance ............................................................................................... 315,537,750 314,492,354

IV. Investment reserve account

Opening balance ............................................................................................. ——

Additions during the year ............................................................................... 1,270,000 —

Deductions during the year ............................................................................ ——

Closing balance ............................................................................................... 1,270,000 —

V. Unrealised investment reserve2

Opening balance ............................................................................................ 36,240 85,451

Additions during the year .............................................................................. 86,956 12,400

Deductions during the year ........................................................................... 89,096 61,611

Closing balance .............................................................................................. 34,100 36,240