ICICI Bank 2014 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F46

with ICICI Securities Primary Dealership Limited amounting to ` 7,189.3 million (March 31, 2013: ` 17,330.7 million), ICICI

Prudential Life Insurance Company Limited amounting to ` 2,448.4 million (March 31, 2013: ` 3,056.9 million) and with

ICICI Lombard General Insurance Company Limited amounting to ` 392.5 million (March 31, 2013: ` 3,314.5 million).

During the year ended March 31, 2014, the Bank invested in the equity shares of India Infradebt Limited amounting to Nil

(March 31, 2013: ` 900.0 million), ICICI Lombard General Insurance Company Limited amounting to Nil (March 31, 2013:

` 740.0 million) and Mewar Aanchalik Gramin Bank amounting to Nil (March 31, 2013: ` 18.6 million).

Sale of investments

During the year ended March 31, 2014, the Bank sold certain investments to its subsidiaries amounting to ` 9,061.8

million (March 31, 2013: ` 12,119.1 million) and to its associates/joint ventures/other related entities amounting to ` 147.8

million (March 31, 2013: Nil). The material transactions for the year ended March 31, 2014 were with ICICI Prudential Life

Insurance Company Limited amounting to ` 4,898.3 million (March 31, 2013: ` 4,088.0 million), ICICI Lombard General

Insurance Company Limited amounting to ` 2,497.8 million (March 31, 2013: ` 1,321.2 million) and with ICICI Securities

Primary Dealership Limited amounting to ` 1,649.4 million (March 31, 2013: ` 6,459.7 million).

Investment in Certificate of Deposits (CDs)/bonds issued by ICICI Bank

During the year ended March 31, 2014, subsidiaries have invested in CDs/bonds issued by the Bank amounting to

Nil (March 31, 2013: ` 1,914.0 million). The material transactions for the year ended March 31, 2014 were with ICICI

Prudential Life Insurance Company Limited amounting to Nil (March 31, 2013: ` 1,407.2 million) and with ICICI Securities

Primary Dealership Limited amounting to Nil (March 31, 2013: ` 506.8 million).

During the year ended March 31, 2014, the Bank received a consideration from ICICI Bank Canada amounting to ` 4,070.4

million (equivalent to CAD 75.0 million) (March 31, 2013: Nil) on account of buyback of equity shares by ICICI Bank

Canada.

During the year ended March 31, 2014, the Bank received a consideration from ICICI Bank UK PLC amounting to ` 2,995.8

million (equivalent to USD 50 million) (March 31, 2013: Nil) on account of redemption of bonds by ICICI Bank UK PLC.

During the year ended March 31, 2014, the Bank received a consideration from ICICI Bank UK PLC amounting to Nil

[March 31, 2013: ` 5,428.5 million (equivalent to USD 100.0 million)] on account of buyback of equity/preference shares

by ICICI Bank UK PLC.

During the year ended March 31, 2014, the Bank received a consideration from ICICI Emerging Sectors Fund amounting

to ` 358.0 million (March 31, 2013: Nil) and from ICICI Eco-net Internet and Technology Fund amounting to ` 126.7 million

(March 31, 2013: Nil) on account of redemption of units and distribution of gain/loss on units.

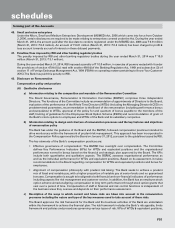

Reimbursement of expenses to subsidiaries

During the year ended March 31, 2014, the Bank reimbursed expenses to its subsidiaries amounting to ` 46.6 million

(March 31, 2013: ` 29.6 million). The material transactions for the year ended March 31, 2014 were with ICICI Bank UK PLC

amounting to ` 33.7 million (March 31, 2013: ` 5.8 million), ICICI Bank Canada amounting to ` 12.9 million (March 31, 2013:

` 7.3 million) and with ICICI Home Finance Company Limited amounting to Nil (March 31, 2013: ` 16.5 million).

Reimbursement of expenses to the Bank

During the year ended March 31, 2014, subsidiaries reimbursed expenses to the Bank amounting to ` 19.9 million (March

31, 2013: ` 29.1 million). The material transactions for the year ended March 31, 2014 were with ICICI Bank UK PLC

amounting to ` 14.7 million (March 31, 2013: ` 18.0 million), ICICI Bank Canada amounting to ` 5.2 million (March 31,

2013: ` 5.0 million) and with ICICI Home Finance Company Limited amounting to Nil (March 31, 2013: ` 6.1 million).

Brokerage, fees and other expenses

During the year ended March 31, 2014, the Bank paid brokerage, fees and other expenses to its subsidiaries amounting

to ` 671.8 million (March 31, 2013: ` 557.3 million) and to its associates/joint ventures/other related entities amounting to

` 3,179.4 million (March 31, 2013: ` 2,653.2 million). The material transactions for the year ended March 31, 2014 were

with I-Process Services (India) Private Limited amounting to ` 1,664.2 million (March 31, 2013: ` 1,045.2 million), ICICI

Merchant Services Private Limited amounting to ` 1,353.3 million (March 31, 2013: ` 1,305.2 million) and with ICICI Home

Finance Company Limited amounting to ` 549.8 million (March 31, 2013: ` 373.7 million).

Income on custodial services

During the year ended March 31, 2014, the Bank recovered custodial charges from its subsidiaries amounting to ` 3.7

million (March 31, 2013: ` 5.1 million) and from its associates/joint ventures/other related entities amounting to ` 0.5

million (March 31, 2013: ` 0.9 million). The material transactions for the year ended March 31, 2014 were with ICICI

Securities Primary Dealership Limited amounting to ` 3.6 million (March 31, 2013: ` 4.8 million).

forming part of the Accounts (Contd.)

schedules