ICICI Bank 2014 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

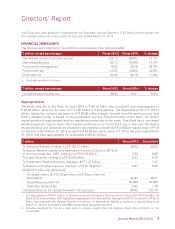

Directors’ Report

additional Director effective March 6, 2014. V. K. Sharma holds office

upto the date of the forthcoming Annual General Meeting (AGM) and is

eligible for appointment.

Classification of Directors as per CA2013/Act

Section 149 of the Act which defines the composition of the Board

and the criteria for a director to be considered as independent has

been notified effective April 1, 2014. Nominee directors i.e. a director

nominated by any financial institution in pursuance of the provisions of

any law for the time being in force, or of any agreement, or appointed by

any Government, or any other person to represent the interests of the

financial institution/Government/any other person are excluded from

the definition of independent director. The Board of the Bank consists

of 12 Directors, out of which seven are independent Directors, one is a

Government Nominee Director and four are Executive Directors.

In classification of Directors as independent, the Bank has relied on the

declaration of independence provided by the independent Directors as

prescribed under Section 149(7) of the Act and placed at the Board

Meeting of the Bank held on April 25, 2014 and based on the applicable

RBI guidelines and circulars and the legal advice obtained in this regard.

Retirement by rotation

Section 149 provides that an independent director shall not hold office

for more than two consecutive terms of five years each provided that the

director is re-appointed by passing a special resolution on completion

of first term of five consecutive years. Independent directors are no

longer liable to retire by rotation.

As per the explanation provided under Section 149 of the Act, any

tenure of an independent director on the date of commencement

of this Section i.e. April 1, 2014 shall not be counted as a term. The

tenure of every independent director to compute the period of first five

consecutive years would be reckoned afresh from April 1, 2014.

The Banking Regulation Act, 1949 (BR Act) specifies that no director other

than Chairman or wholetime Director shall hold office continuously for a

period exceeding eight years. The CA2013 also provides that in respect

of banking companies, the provisions of the Act shall apply except in

so far as the said provisions are inconsistent with the provisions of the

BR Act.

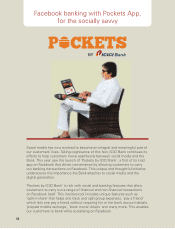

“We continue to innovate

to cater to the evolving

preferences of Indian

consumers and deliver

a safe, convenient and

rewarding banking

experience. Our Khayaal

Aapka philosophy of

empowering customers

using technology

continues to delight

them. This year we

introduced Tab Banking,

Facebook Banking and

next generation internet

banking and scaled up

our 24x7 Touch Banking

branches and MySavings

Rewards programme.

We continue to use

technology as a

differentiator to create

an ecosystem delivering

products and services to

millions of customers in

rural India.”

RAJIV SABHARWAL

Executive Director

Annual Report 2013-2014 13