ICICI Bank 2014 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F71

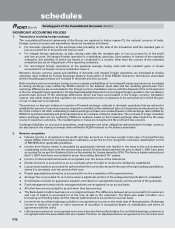

policies are reinstated. Top-up premiums paid by unit linked policyholders’ are considered as single premium and

recognised as income when the associated units are created. Income from unit linked policies, which includes fund

management charges, policy administration charges, mortality charges and other charges, if any, are recovered

from the linked funds in accordance with the terms and conditions of the policy and are recognised when due.

zIn the case of general insurance business, premium is recorded for the policy period at the commencement of risk

and for instalment cases, it is recorded on instalment due dates. Premium earned is recognised as income over

the period of the risk or the contract period based on 1/365 method, whichever is appropriate, on a gross basis,

net of service tax. Any subsequent revision to premium is recognised over the remaining period of risk or contract

period. Adjustments to premium income arising on cancellation of policies are recognised in the period in which

the policies are cancelled. Commission on re-insurance ceded is recognised as income in the period of ceding the

risk. Profit commission under re-insurance treaties, wherever applicable, is recognised as income in the period of

final determination of profits and combined with commission on reinsurance ceded.

zIn the case of general insurance business, insurance premium on ceding of the risk is recognised in the period in

which the risk commences. Any subsequent revision to premium ceded is recognised in the period of such revision.

Adjustment to re-insurance premium arising on cancellation of policies is recognised in the period in which they

are cancelled. In case of life insurance business, reinsurance premium ceded is accounted in accordance with the

terms and conditions of the relevant treaties with the reinsurer. Profit commission on reinsurance ceded is netted

off against premium ceded on reinsurance.

zIn the case of general insurance business, premium deficiency is recognised when the sum of expected claim costs

and related expenses and maintenance costs exceed the reserve for unexpired risks and is computed at a company

level. The expected claim cost is calculated and duly certified by the Appointed Actuary.

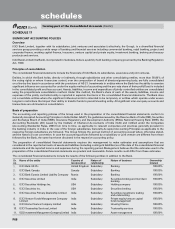

3. Stock based compensation

The following entities within the group have granted stock options to their employees:

•ICICI Bank Limited

•ICICI Prudential Life Insurance Company Limited

•ICICI Lombard General Insurance Company Limited

The Employees Stock Option Scheme (the Scheme) of the Bank provides for grant of options on the Bank’s equity shares

to wholetime directors and employees of the Bank and its subsidiaries. The Scheme provides that employees are granted

an option to subscribe to equity shares of the Bank that vest in a graded manner. The options may be exercised within

a specified period. ICICI Prudential Life Insurance Company and ICICI Lombard General Insurance Company have also

formulated similar stock option schemes for their employees for grant of equity shares of their respective companies.

The Group, except the banking subsidiaries, follows the intrinsic value method to account for its stock-based employee

compensation plans. Compensation cost is measured as the excess, if any, of the fair market price of the underlying

stock over the exercise price on the grant date and amortised over the vesting period. The fair market price is the latest

closing price, immediately prior to the grant date, which is generally the date of the Board of Directors meeting in which

the options are granted, on the stock exchange on which the shares of the Bank are listed. If the shares are listed on

more than one stock exchange, then the stock exchange where there is highest trading volume on the said date is

considered. In the case of ICICI Prudential Life Insurance Company and ICICI Lombard General Insurance Company, the

fair value of the shares is determined based on an external valuation report. The banking subsidiaries namely, ICICI Bank

UK and ICICI Bank Canada account for the cost of the options granted to employees by ICICI Bank using the fair value

method based on binomial tree model.

4. Income taxes

Income tax expense is the aggregate amount of current tax and deferred tax expense incurred by the Group. The current

tax expense and deferred tax expense is determined in accordance with the provisions of the Income Tax Act, 1961

and as per Accounting Standard 22 - Accounting for Taxes on Income, respectively. Deferred tax adjustments comprise

changes in the deferred tax assets or liabilities during the year.

Deferred tax assets and liabilities are recognised by considering the impact of timing differences between taxable

income and accounting income for the current year, and carry forward losses. Deferred tax assets and liabilities are

measured using tax rates and tax laws that have been enacted or substantively enacted at the balance sheet date. The

impact of changes in the deferred tax assets and liabilities is recognised in the profit and loss account.

Deferred tax assets are recognised and re-assessed at each reporting date, based upon the management’s judgement

as to whether their realisation is considered as reasonably certain. However, in case of domestic companies, where

there is unabsorbed depreciation or carried forward loss under taxation laws, deferred tax assets are recognised only if

there is virtual certainty of realisation of such assets.

In the consolidated financial statements, deferred tax assets and liabilities are computed at an individual entity level and

aggregated for consolidated reporting.

forming part of the Consolidated Accounts (Contd.)

schedules