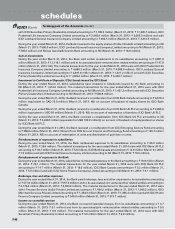

ICICI Bank 2014 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F36

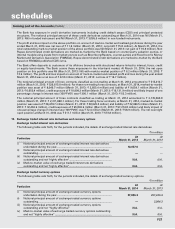

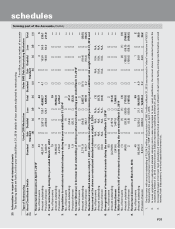

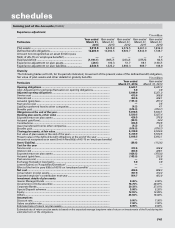

(III) Overseas assets, NPAs and revenue

` in million

Particulars Year ended

March 31, 2014

Year ended

March 31, 2013

Total assets1 ................................................................................................. 1,046,422.0 935,097.0

Total NPAs (net) ........................................................................................... 6,086.6 3,624.0

Total revenue1 .............................................................................................. 58,949.7 46,925.8

1. Represents the total assets and total revenue of foreign operations as reported in Schedule 18 notes to accounts note no. 4

on information about business and geographical segments, of the financial statements.

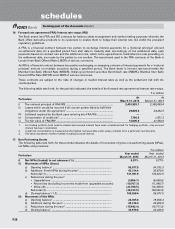

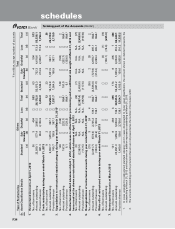

(IV) Off-balance sheet special purpose vehicles (SPVs) sponsored (which are required to be consolidated as per

accounting norms)

(a) The following table sets forth, the names of SPVs/trusts sponsored by the Bank/subsidiaries which are consolidated.

Sr.

No. Name of the SPV sponsored1

A. Domestic

1. ICICI Equity Fund

2. ICICI Strategic Investments Fund

B. Overseas

None

1. The nature of business of the above entities is venture capital fund.

2. During the three months ended December 31, 2013, ICICI Venture Value Fund ceased to be a consolidating entity and

accordingly, has not been consolidated.

3. During the three months ended March 31, 2014, ICICI Eco-net Internet and Technology Fund and ICICI Emerging Sectors

Fund ceased to be a consolidating entity and accordingly, have not been consolidated.

(b) The Following table set forth, the names of SPVs/trusts which are not sponsored by the Bank/subsidiaries and

are consolidated.

Sr.

No.

Name of the SPV1

A. Domestic

None

B. Overseas

None

1. During the three months ended March 31, 2014, Rainbow fund ceased to be a consolidating entity and accordingly, has not

been consolidated

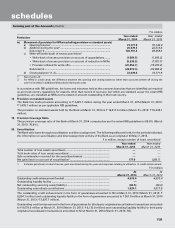

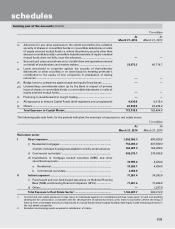

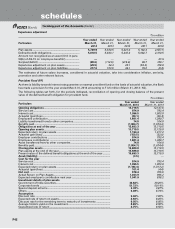

26. Exposure to sensitive sectors

The Bank has exposure to sectors, which are sensitive to asset price fluctuations. The sensitive sectors include capital

markets and real estate.

The following table sets forth, for the periods indicated, the position of exposure to capital market sector.

` in million

At

March 31, 2014

At

March 31, 2013

Capital market sector

iDirect investment in equity shares, convertible bonds, convertible

debentures and units of equity-oriented mutual funds, the corpus of

which is not exclusively invested in corporate debt ................................... 17,821.5 16,345.8

ii Advances against shares/bonds/ debentures or other securities or on

clean basis to individuals for investment in shares (including IPOs/ESOPs),

convertible bonds, convertible debentures, and units of equity-oriented

mutual funds .................................................................................................. 11,614.4 11,791.5

iii Advances for any other purposes where shares or convertible bonds or

convertible debentures or units of equity oriented mutual funds are taken

as primary security ....................................................................................... 56,833.3 30,736.6

forming part of the Accounts (Contd.)

schedules