ICICI Bank 2014 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Annual Report 2013-2014 25

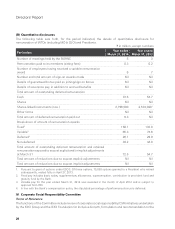

The KPIs include both quantitative and qualitative aspects. The BGRNC assesses organisational

performance as well as the individual performance for WTDs and equivalent positions. Based on

its assessment, it makes recommendations to the Board regarding compensation for WTDs and

equivalentpositionsandbonusforemployees.

• Alignment of compensation philosophy with prudent risk taking: The Bank seeks to achieve a

prudentmixoffixedandvariablepay,withahigherproportionofvariablepayatseniorlevelsand

noguaranteedbonuses. Compensationissoughttobe alignedtobothfinancialand non-financial

indicatorsofperformanceincludingaspectslikeriskmanagementandcustomerservice.Inaddition,

the Bank has an employee stock option scheme aimed at aligning compensation to long term

performancethroughstockoptiongrantsthatvestoveraperiodoftime.Compensationofstaffin

financialandriskcontrolfunctionsisindependentofthebusinessareastheyoverseeanddepends

ontheirperformanceassessment.

c) Description of the ways in which current and future risks are taken into account in the

remuneration processes including the nature and type of the key measures used to take account

of these risks

TheBoardapprovestheriskframeworkfortheBankandthebusinessactivitiesoftheBankareundertaken

withinthisframeworktoachievethefinancialplan.TheriskframeworkincludestheBank’sriskappetite,

limitsframeworkandpoliciesandproceduresgoverningvarioustypesofrisk.KPIsofWTDs&equivalent

positions,as well as employees,incorporate relevant risk management related aspects. Forexample,

inadditiontoperformancetargetsinareassuchasgrowthandprofits,performanceindicatorsinclude

aspectssuchasthedesiredfundingprofileandassetquality.TheBGRNCtakesinto considerationall

theaboveaspectswhileassessingorganisationalandindividualperformanceandmakingcompensation

relatedrecommendationstotheBoard.

d) Description of the ways in which the Bank seeks to link performance during a performance

measurement period with levels of remuneration

The level of performance bonus, increments in salary and allowances and grant of stock options are

determinedbasedontheassessmentofperformanceasdescribedabove.

e) Discussion of the Bank’s policy on deferral and vesting of variable remuneration and the Bank’s

policy and criteria for adjusting deferred remuneration before vesting and after vesting

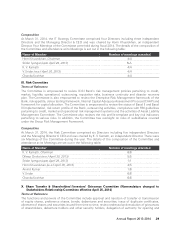

The quantum of bonus for an employee does not exceed a certain percentage (as stipulated in the

compensationpolicy)ofthetotalfixedpayina year.Withinthispercentage,ifthequantumofbonus

exceedsapredefinedthresholdpercentageofthetotalfixedpay,apartofthebonusisdeferredandpaid

overaperiod.Thedeferredportionissubjecttomalus,underwhichtheBankwouldpreventvestingofall

orpartofthevariablepayintheeventofanenquirydetermininggrossnegligenceorbreachofintegrity.

Insuchcases,variablepayalreadypaidoutisalsosubjecttoclawbackarrangements.

f) Description of the different forms of variable remuneration that the Bank utilises and the rationale

for using these different forms

The Bank pays performance linked retention pay (PLRP) to its front-line staff and junior management

andperformancebonustoitsmiddleandseniormanagement.PLRPaimstorewardfrontlineandjunior

managers,mainlyon thebasisofskillmaturityattainedthroughexperienceandcontinuityinrolewhichis

akeydifferentiatorforcustomerservice.TheBankalsopaysvariablepaytosalesofficersandrelationship

managers in wealth management roles while ensuring that such pay-outs are in accordance with the

requirementofRBIfromtimetotime.TheBankensureshigherproportionofvariablepayatseniorlevels

andlowervariablepayforfront-linestaffandjuniormanagementlevels.