ICICI Bank 2014 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ICICI Bank has always leveraged technology to create

new paradigms in financial services in India. We have

continued to launch a number of new initiatives in

recent years. At March 31, 2014, we had 101 fully

electronic Touch Banking branches across 33 cities.

These branches give customers the ability to complete

their banking transactions at their convenience and

also access 24x7 customer service support. During the

year, we launched our mobile branch service, whereby

we achieve deeper penetration of our services in

rural locations. We strengthened our presence on

social media through Pockets on Facebook, a unique

solution which allows our customers to carry out

banking transactions while on Facebook. We launched

Tab Banking, which enables our customers to open

accounts or apply for loans at a time and place of

their convenience. We invested in our internet and

mobile banking platforms to improve the customer

experience, and leveraged technology to provide

banking solutions to the government sector.

Our subsidiaries also achieved healthy performance in

fiscal 2014. Our life insurance subsidiary sustained its

profitability and maintained its position as the largest

private sector life insurer in the country. Our general

insurance subsidiary saw strong improvement in

profitability in fiscal 2014 while maintaining its market

leadership position among private players. Our asset

management subsidiary became the second largest

mutual fund manager in the country in fiscal 2014, and

was recognised for its strong fund performance. Our

other domestic subsidiaries continued to maintain their

profitability, despite the volatility in financial markets.

Our overseas banking subsidiaries in UK and Canada,

after a period of consolidation, have seen selective

growth in business along with an improvement in

profitability. We have also focused on optimising the

capital levels in these businesses through repatriation

of capital and dividend payouts.

The ICICI Group remains committed towards nation

building and contributing to society. We have

continued to focus on the areas of elementary

education, healthcare, sustainable livelihood through

skill development and financial inclusion. In October

2013, we launched a major initiative in the area of

sustainable livelihoods by setting up the ICICI Academy

for Skills for imparting vocational training to youth from

lower income segments. The Academy currently has

nine training centres spread across the country. Over

2,400 youth have joined various courses across these

centres since October 2013, of whom over 1,000 have

already completed their training. Around 35% of the

trainees are young women. All the candidates who

have completed their training have been employed

by various companies and businesses, apart from a

few who have opted for self-employment. The Bank

has also continued to make progress in its financial

inclusion initiatives. At March 31, 2014 the Bank had

opened 448 branches in unbanked rural areas. Our

financial inclusion plan covered over 15,500 villages

and we had 17.8 million financial inclusion accounts.

During the year, we achieved the milestone of one

million women beneficiaries under our Self Help

Group programme.

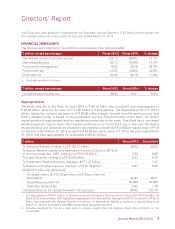

In summary, fiscal 2014 was a year in which we

focused on further strengthening our businesses,

network, technological capabilities and operating

and financial parameters. At the same time we

were cognizant of the risks in the environment and

calibrated our approach accordingly. Our outlook for

the future is positive – we believe that the formation

of a stable government with a focus on growth will

help realise India’s vast potential. Our strong and

diversified franchise, large distribution network,

healthy capital position and sustained improvements

in our balance sheet & profitability profile give us the

ability to leverage opportunities for profitable growth.

I look forward to your continued support in taking

your Bank forward on this journey of sustainable and

profitable growth.

With best wishes,

Chanda Kochhar

Annual Report 2013-2014 5