ICICI Bank 2014 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196

|

|

Annual Report 2013-2014 65

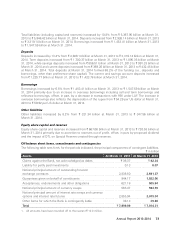

Operating results data

The following table sets forth, for the periods indicated, the operating results data.

` in billion, except percentages

Particulars Fiscal 2013 Fiscal 2014 % change

Interest income ` 400.75 ` 441.78 10.2%

Interest expense 262.09 277.03 5.7

Net interest income 138.66 164.75 18.8

Non-interest income

- Fee income169.01 77.58 12.4

- Treasury income 4.95 10.17 0.0

- Dividend from subsidiaries 9.12 12.96 42.1

- Other income (including lease income)20.38 3.57 —

Operating income 222.12 269.03 21.1

Operating expenses 90.13 103.09 14.4

Operating profit 131.99 165.94 25.7

Provisions, net of write-backs 18.03 26.26 45.6

Profit before tax 113.96 139.68 22.6

Tax, including deferred tax 30.71 41.58 35.4

Profit after tax ` 83.25 ` 98.10 17.8%

1. Includes merchant foreign exchange income and margin on customer derivative transactions.

2. Includes exchange gain on repatriation of retained earnings from overseas branches.

3. All amounts have been rounded off to the nearest ` 10.0 million.

4. Prior period figures have been re-grouped/re-arranged, where necessary.

Key ratios

The following table sets forth, for the periods indicated, the key financial ratios.

Particulars Fiscal 2013 Fiscal 2014

Return on average equity (%)112.94 13.73

Return on average assets (%)21.66 1.76

Earnings per share (`) 72.20 84.99

Book value per share (`) 578.25 633.98

Fee to income (%) 31.11 28.87

Cost to income (%)340.49 38.25

1. Return on average equity is the ratio of the net profit after tax to the quarterly average equity share capital and

reserves.

2. Return on average assets is the ratio of net profit after tax to average assets. The average balances are the

averages of daily balances, except averages of foreign branches which are calculated on a fortnightly basis.

3. Cost represents operating expense excluding lease depreciation. Income represents net interest income and

non-interest income and is net of lease depreciation.