ICICI Bank 2014 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

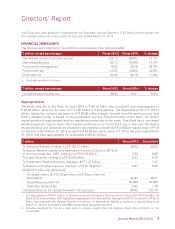

the growth in corporate and small & medium

enterprise lending, enhanced our monitoring of

the portfolio to enable us to take proactive action

and focused on improving our core operating

parameters. As a result, we were able to contain

the net NPA ratio to 0.82% at March 31, 2014 and

grow our profit after tax by 17.8% in fiscal 2014,

despite higher provisions as well as the impact of

tax and regulatory changes.

• Thislevelofprofitaftertaxrepresentsareturnon

average assets (RoA) of 1.76%, an improvement

of 10 basis points compared to the RoA of 1.66%

in fiscal 2013.

During the year, we added 653 branches and 834

ATMs to our network. Our network of 3,753 branches

continues to be the largest among private sector

banks in India. This is supplemented by our network

of 11,315 ATMs at March 31, 2014.

I am happy to report that during fiscal 2014 we

sustained and further improved our performance,

despite an environment marked by elevated interest

rates, low growth and significant market volatility. Given

the developments in the environment, we adopted

a balanced approach to growth, profitability and risk

management. This strategy has helped us strengthen

every area of our business. During the year, we have

further strengthened our position with continued

improvements in our key financial parameters, a strong

deposit franchise, a large and expanding distribution

network and a healthy capital position; thereby creating

a platform for robust growth.

In this context, I would like to share with you some of

our key performance highlights for the year:

• We achieved our objective of accelerating

the momentum in retail lending. Our retail

disbursements increased by about 37%,

translating into an overall year-on-year portfolio

growth of 23%.

• We continued to strengthen our funding profile,

mobilising ` 198.01 billion of CASA deposits

in fiscal 2014. The year-on-year growth in

CASA deposits was 16% and the CASA ratio

improved from 42% at March 31, 2013 to 43%

at March 31, 2014.

• Weimprovedournetinterestmarginbyover20

basis points from 3.11% in fiscal 2013 to 3.33%

in fiscal 2014.

• Our fee income grew by 12% in fiscal 2014

compared to 3.0% in fiscal 2013. This was driven

by our continued focus on granular fee income

streams from commercial banking, forex and

derivatives and retail banking.

• We continued to focus on efficiency and

productivity and further reduced the cost-to-

income ratio to 38.2%.

• Giventhemacro-economicscenario,assetquality

challenges for the banking sector intensified

during the year. In response, we calibrated

Message from the

Managing Director

& CEO

CHANDA KOCHHAR

Managing Director & CEO

4