ICICI Bank 2014 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196

|

|

Annual Report 2013-2014 85

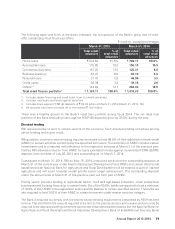

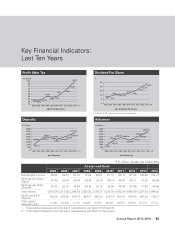

Key Financial Indicators:

Last Ten Years

`

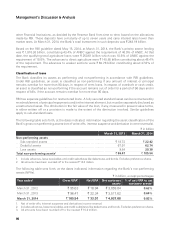

Dividend Per Share

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 FY

8.50 8.50

10.00

11.00 11.00

12.00

14.00

16.50

20.00

23.00

25

20

15

10

5

0

Dividend Per Share

` in billion, except per share data

At year–end fiscal

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Net interest income 29.32 39.07 56.37 73.04 83.67 81.14 90.17 107.34 138.66 164.75

Earnings per share

(Basic) 27.55 32.49 34.84 39.39 33.76 36.14 45.27 56.11 72.20 84.99

Earnings per share

(Diluted) 27.33 32.15 34.64 39.15 33.70 35.99 45.06 55.95 71.93 84.65

Total assets 1,676.59 2,513.89 3,446.58 3,997.95 3,793.01 3,634.00 4,062.34 4,890.69 5,367.95 5,946.42

Equity capital &

reserves 125.50 222.06 243.13 464.71 495.33 516.18 550.91 604.05 667.06 732.13

Total capital

adequacy ratio 11.8% 13.4% 11.7% 14.0%115.5%119.4%119.5%118.5%118.7%117.7%2

1. Total capital adequacy ratio has been calculated as per Basel II framework.

2. Total capital adequacy ratio has been calculated as per Basel III framework.

For fiscal 2014, represents proposed dividend.

` in billion

100

90

80

70

60

50

40

30

20

10

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 FY

20.05

25.40

31.10

41.58

37.58 40.25

51.51 64.65

83.25

98.10

Profit After Tax

Profit After Tax

Advances

Advances

4,000

3,500

3,000

2,500

2,000

1,500

1,000

500

02005 2006 2007 2008 2009 2010 2011 2012 2013 2014 FY

` in billion

914.05

1,461.63

1,958.66

2,256.16 2,183.11

2,902.49

3,387.03

1,812.06

2,163.66

2,537.28

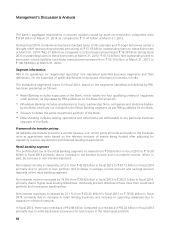

Deposits

Deposits

4,000

3,500

3,000

2,500

2,000

1,500

1,000

500

02005 2006 2007 2008 2009 2010 2011 2012 2013 2014 FY

` in billion

998.19

2,305.10

2,020.17 2,256.02

2,555.00

2,926.13

1,650.83

2,444.31 2,183.48

3,319.14