ICICI Bank 2014 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F35

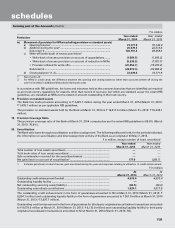

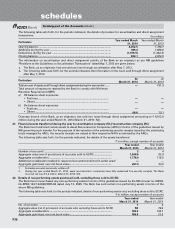

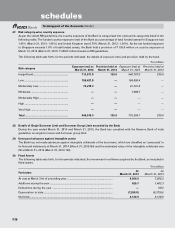

24. Floating provision

The Bank holds floating provision of ` 1.9 million at March 31, 2014 (March 31, 2013:` 1.9 million) taken over from

erstwhile Bank of Rajasthan on amalgamation.

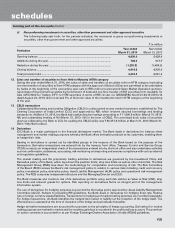

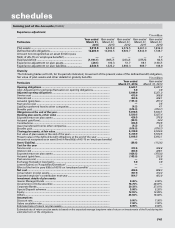

25. Concentration of Deposits, Advances, Exposures and NPAs

(I) Concentration of deposits, advances, exposures and NPAs

` in million

Concentration of deposits

At

March 31, 2014

At

March 31, 2013

Total deposits of 20 largest depositors ...................................................... 242,537.6 280,257.1

Deposits of 20 largest depositors as a percentage of total deposits of the Bank

7.31% 9.58%

` in million

Concentration of advances1

At

March 31, 2014

At

March 31, 2013

Total advances to 20 largest borrowers (including banks) ....................... 1,154,740.4 1,095,316.4

Advances to 20 largest borrowers as a percentage of total advances

of the Bank .................................................................................................. 15.73% 15.44%

1.

Represents credit exposure (funded and non-funded) including derivatives exposures as per RBI guidelines on exposure norms.

` in million

Concentration of exposures1At

March 31, 2014

At

March 31, 2013

Total exposure to 20 largest borrowers/customers (including banks)...... 1,190,611.6 1,126,427.8

Exposures to 20 largest borrowers/customers as a percentage of total

exposure of the Bank ................................................................................. 15.21% 14.85%

1. Represents credit and investment exposures as per RBI guidelines on exposure norms.

` in million

Concentration of NPAs At

March 31, 2014

At

March 31, 2013

Total exposure1 to top 4 NPA accounts ...................................................... 17,486.9 12,511.3

1. Represents gross exposure (funded and non-funded).

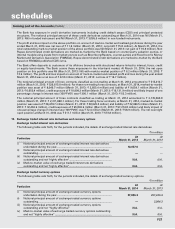

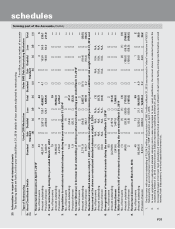

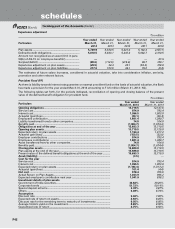

(II) Sector-wise NPAs

Sr.

no. Sector Percentage of NPAs to total

advances in that sector

At

March 31, 2014 At

March 31, 2013

Gross Net Gross Net

1. Agriculture and allied activities1 ........................................... 3.62% 0.93% 3.60% 0.75%

2. Industry (Micro & small, medium and large) ........................ 3.04% 1.22% 2.28% 0.70%

3. Services ................................................................................. 3.45% 1.14% 2.47% 1.05%

4. Personal loans2 ...................................................................... 2.49% 0.41% 5.80% 0.56%

Total ....................................................................................... 3.03% 0.97% 3.22% 0.77%

1. Represents loans towards agriculture and allied activities that qualify for priority sector lending.

2. Excludes retail loans towards agriculture and allied activities that qualify for priority sector lending. Excludes commercial

business loans, developer financing and dealer funding.

forming part of the Accounts (Contd.)

schedules