ICICI Bank 2014 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F27

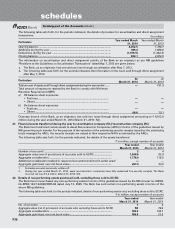

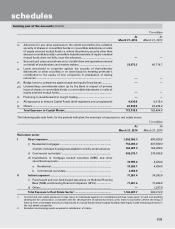

The Bank has exposure in credit derivative instruments including credit default swaps (CDS) and principal protected

structures. The notional principal amount of these credit derivatives outstanding at March 31, 2014 was Nil (March 31,

2013: Nil) in funded instrument and Nil (March 31, 2013: ` 3,065.6 million) in non-funded instruments.

The profit and loss impact on the above portfolio on account of mark-to-market and realised gain/losses during the year

ended March 31, 2014 was net loss of ` 11.8 million (March 31, 2013: net profit ` 75.0 million). At March 31, 2014, the

total outstanding mark-to-market position of the above portfolio was Nil (March 31, 2013: net gain of ` 10.8 million). Non

Rupee denominated credit derivatives are marked-to-market by the Bank based on counter-party valuation quotes, or

internal models using inputs from market sources such as Bloomberg/Reuters, counter-parties and Fixed Income Money

Market and Derivative Association (FIMMDA). Rupee denominated credit derivatives are marked-to-market by the Bank

based on FIMMDA published CDS curve.

The Bank offers deposits to customers of its offshore branches with structured returns linked to interest, forex, credit

or equity benchmarks. The Bank covers these exposures in the inter-bank market. At March 31, 2014, the net open

position on this portfolio was Nil (March 31, 2013: Nil) with mark-to-market position of ` 6.2 million (March 31, 2013: `

13.9 million). The profit and loss impact on account of mark-to-market and realised profit and loss during the year ended

March 31, 2014 was a net loss of ` 22.0 million (March 31, 2013: net loss of ` 18.7 million).

The notional principal amount of forex contracts classified as non-trading at March 31, 2014 amounted to ` 515,313.7

million (March 31, 2013: ` 526,615.8 million). For these non-trading forex contracts, at March 31, 2014, marked-to-market

position was asset of ` 8,549.7 million (March 31, 2013: ` 2,855.4 million) and liability of ` 9,654.1 million (March 31,

2013: ` 6,652.4 million), credit exposure of ` 10,899.3 million (March 31, 2013: ` 16,131.9 million) and likely impact of one

percentage change in interest rate (100*PV01) was ` 396.1 million (March 31, 2013: ` 52.3 million).

The notional principal amount of forex contracts classified as trading at March 31, 2014 amounted to ` 2,176,060.0

million (March 31, 2013: ` 2,311,888.1 million). For these trading forex contracts, at March 31, 2014, marked-to-market

position was asset of ` 38,418.7 million (March 31, 2013: ` 38,526.6 million) and liability of ` 32,983.5 million (March 31,

2013: ` 32,462.9 million), credit exposure of ` 95,046.9 million (March 31, 2013: ` 97,274.0 million) and likely impact of

one percentage change in interest rate (100*PV01) was ` 72.4 million (March 31, 2013: ` 58.9 million). The net overnight

open position at March 31, 2014 was ` 511.7 million (March 31, 2013: ` 573.8 million).

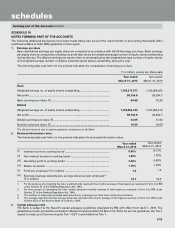

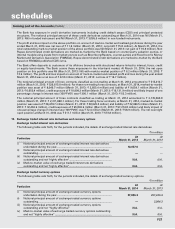

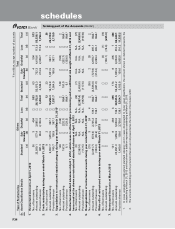

15. Exchange traded interest rate derivatives and currency options

Exchange traded interest rate derivatives

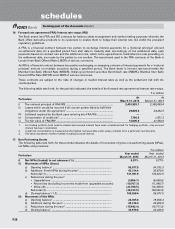

The following table sets forth, for the periods indicated, the details of exchange traded interest rate derivatives.

` in million

Particulars At

March 31, 2014

At

March 31, 2013

i) Notional principal amount of exchange traded interest rate derivatives

undertaken during the year ........................................................................... 10,057.6 —

ii) Notional principal amount of exchange traded interest rate derivatives

outstanding .................................................................................................... ——

iii) Notional principal amount of exchange traded interest rate derivatives

outstanding and not "highly effective" .......................................................... N.A. N.A.

iv) Mark-to-market value of exchange traded interest rate derivatives

outstanding and not "highly effective" .......................................................... N.A. N.A.

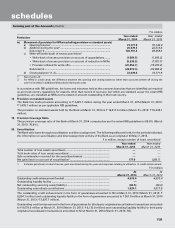

Exchange traded currency options

The following table sets forth, for the periods indicated, the details of exchange traded currency options.

` in million

Particulars At

March 31, 2014

At

March 31, 2013

i) Notional principal amount of exchange traded currency options

undertaken during the year ........................................................................... 37,806.3 257,249.4

ii) Notional principal amount of exchange traded currency options

outstanding .................................................................................................... —2,084.3

iii) Notional principal amount of exchange traded currency options

outstanding and not “highly effective” N.A. N.A.

iv) Mark-to-market value of exchange traded currency options outstanding

and not “highly effective” ............................................................................. N.A. N.A.

forming part of the Accounts (Contd.)

schedules