ICICI Bank 2014 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F28

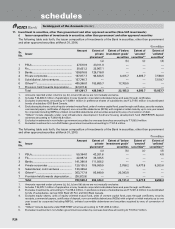

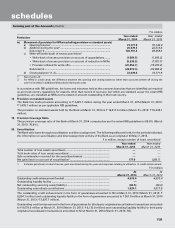

16. Forward rate agreement (FRA)/Interest rate swaps (IRS)

The Bank enters into FRA and IRS contracts for balance sheet management and market making purposes whereby the

Bank offers derivative products to its customers to enable them to hedge their interest rate risk within the prevalent

regulatory guidelines.

A FRA is a financial contract between two parties to exchange interest payments for a ‘notional principal’ amount

on settlement date, for a specified period from start date to maturity date. Accordingly, on the settlement date, cash

payments based on contract rate and the settlement rate, which is the agreed bench-mark/reference rate prevailing on

the settlement date, are made by the parties to one another. The benchmark used in the FRA contracts of the Bank is

London Inter-Bank Offered Rate (LIBOR) of various currencies.

An IRS is a financial contract between two parties exchanging or swapping a stream of interest payments for a ‘notional

principal’ amount on multiple occasions during a specified period. The Bank deals in interest rate benchmarks like

Mumbai Inter-Bank Offered Rate (MIBOR), Indian government securities Benchmark rate (INBMK), Mumbai Inter Bank

Forward Offer Rate (MIFOR) and LIBOR of various currencies.

These contracts are subject to the risks of changes in market interest rates as well as the settlement risk with the

counterparties.

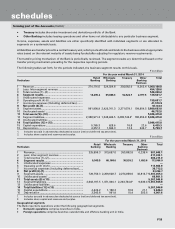

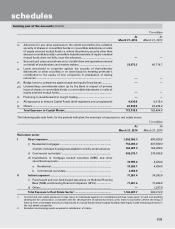

The following table sets forth, for the periods indicated, the details of the forward rate agreements/interest rate swaps.

` in million

Particulars At

March 31, 2014

At

March 31, 2013

i) The notional principal of FRA/IRS ................................................................ 2,401,993.1 2,368,069.4

ii) Losses which would be incurred if all counter parties failed to fulfil their

obligations under the agreement1 ................................................................ 29,809.2 24,232.5

iii) Collateral required by the Bank upon entering into FRA/IRS ...................... ——

iv) Concentration of credit risk2 ......................................................................... 1,766.6 1,971.2

v) The fair value of FRA/IRS3 ............................................................................. 13,005.0 21,530.0

1. For trading portfolio both mark-to-market and accrued interest have been considered and for hedging portfolio, only accrued

interest has been considered.

2. Credit risk concentration is measured as the highest net receivable under swap contracts from a particular counter party.

3. Fair value represents mark-to-market including accrued interest.

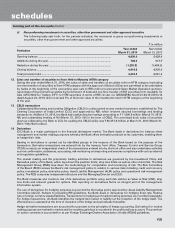

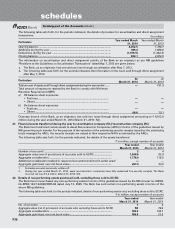

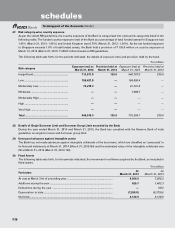

17. Non-Performing Assets

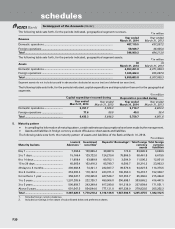

The following table sets forth, for the periods indicated, the details of movement of gross non-performing assets (NPAs),

net NPAs and provisions.

` in million

Particulars Year ended

March 31, 2014

Year ended

March 31, 2013

i) Net NPAs (funded) to net advances (%) ................................................... 0.97% 0.77%

ii) Movement of NPAs (Gross)

a) Opening balance1 ................................................................................ 96,077.5 94,753.3

b) Additions: Fresh NPAs during the year2 ................................................ 45,314.4 35,870.6

Sub-total (1) ......................................................................................... 141,391.9 130,623.9

c) Reductions during the year2

•Upgradations ................................................................................... (3,856.7) (6,600.8)

•Recoveries(excludingrecoveriesmadefromupgradedaccounts) (10,707.3) (11,486.7)

•Write-offs ......................................................................................... (21,769.5) (16,458.9)

Sub-total (2) ............................................................................................... (36,333.5) (34,546.4)

d) Closing balance1 (1-2) .......................................................................... 105,058.4 96,077.5

iii) Movement of Net NPAs

a) Opening balance1 ................................................................................ 22,305.6 18,608.4

b) Additions during the year2 .................................................................. 26,316.4 20,469.0

c) Reductions during the year2 ............................................................... (15,642.4) (16,771.8)

d) Closing balance1 ................................................................................. 32,979.6 22,305.6

forming part of the Accounts (Contd.)

schedules