ICICI Bank 2014 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F1

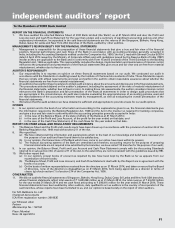

independent auditors’ report

To the Members of ICICI Bank Limited

REPORT ON THE FINANCIAL STATEMENTS

1. We have audited the attached Balance Sheet of ICICI Bank Limited (the ‘Bank’) as at 31 March 2014 and also the Profit and

Loss Account and Cash Flow Statement for the year then ended, and a summary of significant accounting policies and other

explanatory information. Incorporated in the said financial statements are the returns of the Singapore, Bahrain, Hong Kong,

Dubai, Qatar, Sri Lanka and New York-USA branches of the Bank, audited by other auditors.

MANAGEMENT’S RESPONSIBILITY FOR THE FINANCIAL STATEMENTS

2. Management is responsible for the preparation of these financial statements that give a true and fair view of the financial

position, financial performance and cash flows of the Bank in accordance with accounting principles generally accepted in

India, including the Accounting Standards notified under the Companies Act, 1956 (‘the Act‘), read with General Circular 8/2014

dated 4 April 2014 issued by the Ministry of Corporate Affairs and with guidelines issued by the Reserve Bank of India (‘RBI’)

insofar as they are applicable to the Bank and in conformity with Form A and B (revised) of the Third Schedule to the Banking

Regulation Act, 1949 as applicable. This responsibility includes the design, implementation and maintenance of internal control

relevant to the preparation and presentation of the financial statements that give a true and fair view and are free from material

misstatement, whether due to fraud or error.

AUDITOR’S RESPONSIBILITY

3. Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in

accordance with the Standards on Auditing issued by the Institute of Chartered Accountants of India. Those Standards require

that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the

financial statements are free from material misstatement.

4. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements.

The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of

the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control

relevant to the Bank’s preparation and fair presentation of the financial statements in order to design audit procedures that

are appropriate in the circumstances. An audit also includes evaluating the appropriateness of accounting policies used and

the reasonableness of the accounting estimates made by management, as well as evaluating the overall presentation of the

financial statements.

5. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

OPINION

6. In our opinion and to the best of our information and according to the explanations given to us, the financial statements give

the information required by the Banking Regulation Act, 1949 and the Act in the manner so required for banking companies,

and give a true and fair view in conformity with the accounting principles generally accepted in India:

a) in the case of the Balance Sheet, of the state of affairs of the Bank as at 31 March 2014;

b) in the case of the Profit and Loss Account, of the profit for the year ended on that date; and

c) in the case of the Cash Flow Statement, of the cash flows for the year ended on that date.

REPORT ON OTHER LEGAL AND REGULATORY REQUIREMENTS

7. The Balance Sheet and the Profit and Loss Account have been drawn up in accordance with the provision of section 29 of the

Banking Regulation Act, 1949 read with section 211 of the Act.

8. We report that:

(a) We have obtained all the information and explanations which to the best of our knowledge and belief were necessary for

the purpose of our audit and have found them to be satisfactory;

(b) In our opinion, the transactions of the Bank which have come to our notice have been within its powers;

(c)

The financial accounting systems of the Bank are centralised and therefore, accounting returns for the purpose of preparing

financial statements are not required to be submitted by the branches; we have visited 110 branches for the purpose of our audit;

9.

In our opinion, the Balance Sheet, Profit and Loss Account and Cash Flow Statement comply with the Accounting Standards

referred to in sub-section (3C) of section 211 of the Act, to the extent they are not inconsistent with the guidelines issued by RBI.

10. We further report that:

(a) In our opinion, proper books of account as required by law have been kept by the Bank so far as appears from our

examination of those books;

(b) The Balance Sheet, Profit and Loss Account, and Cash Flow Statement dealt with by this Report are in agreement with the

books of account;

(c) On the basis of written representations received from the directors as on 31 March 2014, and taken on record by the Board

of Directors, none of the directors is disqualified as on 31 March 2014, from being appointed as a director in terms of

clause (g) of sub-section (1) of section 274 of the Companies Act, 1956.

OTHER MATTER

11. We did not audit the financial statements of Singapore, Bahrain, Hong Kong, Dubai, Qatar, Sri Lanka and New York-USA branches,

whose financial statements reflect total assets of ` 1,630,498 million as at 31 March 2014, the total revenue of ` 69,223 million

for the year ended 31 March 2014 and net cash flows amounting to ` 209,916 million for the year ended 31 March 2014. These

financial statements have been audited by other auditors, duly qualified to act as auditors in the country of incorporation of the

said branches, whose reports have been furnished to us, and our opinion is based solely on the report of other auditors.

For S.R. Batliboi & Co. LLP

Chartered Accountants

ICAI Firm registration number: 301003E

per Shrawan Jalan

Partner

Membership No.: 102102

Place: Mumbai

Date: 25 April 2014