ICICI Bank 2014 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

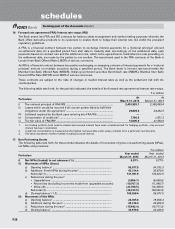

F19

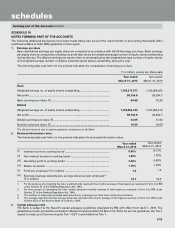

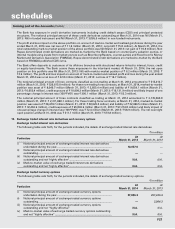

•Treasury includes the entire investment and derivative portfolio of the Bank.

•Other Banking includes leasing operations and other items not attributable to any particular business segment.

Income, expenses, assets and liabilities are either specifically identified with individual segments or are allocated to

segments on a systematic basis.

All liabilities are transfer priced to a central treasury unit, which pools all funds and lends to the business units at appropriate

rates based on the relevant maturity of assets being funded after adjusting for regulatory reserve requirements.

The transfer pricing mechanism of the Bank is periodically reviewed. The segment results are determined based on the

transfer pricing mechanism prevailing for the respective reporting periods.

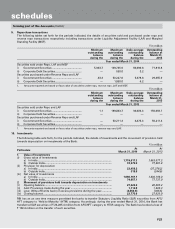

The following tables set forth, for the periods indicated, the business segment results on this basis.

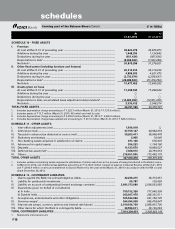

` in million

For the year ended March 31, 2014

Particulars

Retail

Banking

Wholesale

Banking

Treasury Other

Banking

Business

Total

1 Revenue .................................................................. 274,116.0 324,024.8 392,682.6 9,363.4 1,000,186.8

2 Less: Inter-segment revenue ................................. 454,126.6

3 Total revenue (1)–(2) ............................................... 546,060.2

4 Segment results ..................................................... 18,295.2 65,886.3 52,522.7 2,977.5 139,681.7

5 Unallocated expenses ............................................ —

6Operating profit (4)-(5) ............................................. 139,681.7

7Income tax expenses (Including deferred tax) ........ 41,576.9

8 Net profit (6)-(7) ..................................................... 98,104.8

9Segment assets ........................................................ 991,908.9 2,426,741.3 2,371,079.1 109,954.5 5,899,683.8

10 Unallocated assets1 .................................................. 46,732.0

11 Total assets (9)+(10) ............................................... 5,946,415.8

12 Segment liabilities .................................................... 2,388,971.3 1,048,445.5 2,408,745.22100,253.8 5,946,415.8

13 Unallocated liabilities ............................................... —

14 Total liabilities (12)+(13)......................................... 5,946,415.8

15 Capital expenditure .................................................. 5,765.3 628.6 18.8 22.6 6,435.3

16 Depreciation ............................................................. 4,357.2 1,044.3 12.5 345.7 5,759.7

1. Includes tax paid in advance/tax deducted at source (net) and deferred tax asset (net).

2. Includes share capital and reserves and surplus. ` in million

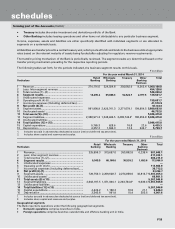

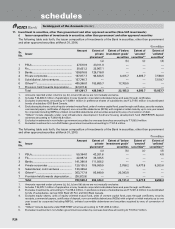

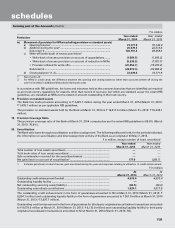

For the year ended March 31, 2013

Particulars

Retail

Banking

Wholesale

Banking

Treasury Other

Banking

Business

Total

1 Revenue .................................................................. 225,856.3 313,687.6 355,862.8 6,238.4 901,645.1

2 Less: Inter-segment revenue ................................. 417,432.1

3 Total revenue (1)–(2) ............................................... 484,213.0

4 Segment results ..................................................... 9,545.5 66,188.6 36,539.2 1,693.6 113,966.9

5 Unallocated expenses ............................................ —

6Operating profit (4)-(5) ............................................. 113,966.9

7 Income tax expenses (Including deferred tax) ...... 30,712.2

8 Net profit (6)-(7) ..................................................... 83,254.7

9 Segment assets ...................................................... 729,750.3 2,269,628.7 2,274,859.6 32,816.7 5,307,055.3

10 Unallocated assets1 ................................................ 60,891.5

11 Total assets (9)+(10) .............................................. 5,367,946.8

12 Segment liabilities .................................................. 2,043,187.5 1,071,994.1 2,243,734.829,030.4 5,367,946.8

13 Unallocated liabilities ............................................. —

14 Total liabilities (12)+(13) ....................................... 5,367,946.8

15 Capital expenditure ................................................ 4,426.2 1,188.2 10.8 21.1 5,646.3

16 Depreciation ........................................................... 3,540.8 991.8 18.4 350.6 4,901.6

1. Includes tax paid in advance/tax deducted at source (net) and deferred tax asset (net).

2. Includes share capital and reserves and surplus.

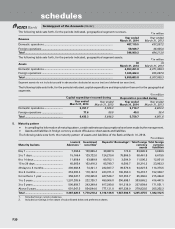

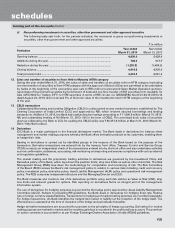

Geographical segments

The Bank reports its operations under the following geographical segments.

•Domestic operations comprise branches in India.

•Foreign operations comprise branches outside India and offshore banking unit in India.

forming part of the Accounts (Contd.)

schedules