ICICI Bank 2014 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F18

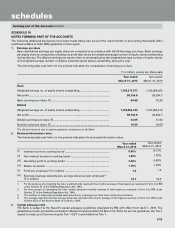

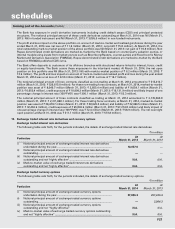

At March 31, 2014, Basel III guidelines require the Bank to maintain a minimum capital to risk-weighted assets ratio

(CRAR) of 9.0% with minimum CET1 of 5.0% and minimum Tier-1 CRAR of 6.5%.

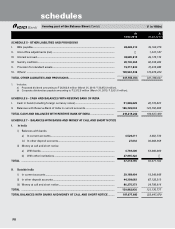

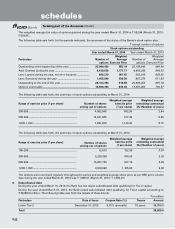

The following table sets forth, for the period indicated, computation of capital adequacy as per Basel III framework.

` in million, except percentages

At

March 31, 2014

Common Equity Tier 1 capital ratio (%) ..................................................................................................... 12.78%

Tier-1 capital ratio (%) ................................................................................................................................... 12.78%

Tier-2 capital ratio (%) ................................................................................................................................... 4.92%

Total Capital ratio (CRAR) (%) ...................................................................................................................... 17.70%

Amount of equity capital raised ................................................................................................................... —

Amount of Additional Tier-1 capital raised; of which

Perpetual Non-Cumulative Preference Shares .......................................................................................

Perpetual Debt Instruments ...................................................................................................................... —

—

Amount of Tier-2 capital raised; of which

Debt capital instrument .............................................................................................................................

Preference Share Capital Instruments .....................................................................................................

[Perpetual Cumulative Preference Shares (PCPS)/Redeemable Non-Cumulative Preference

Shares (RNCPS)/Redeemable Cumulative Preference Shares (RCPS)]

—

—

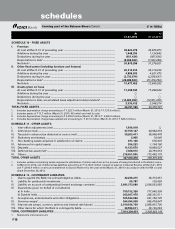

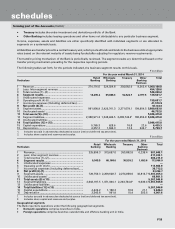

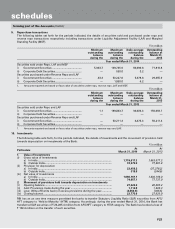

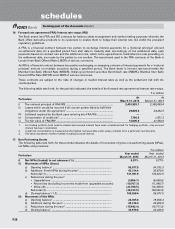

Till March 31, 2013, the Bank was subject to the Basel II capital adequacy guidelines stipulated by RBI with effect from March 31, 2008.

The RBI guidelines on Basel II required the Bank to maintain a minimum CRAR of 9.0% and a minimum Tier-1 CRAR of 6.0% on an

ongoing basis.

The following table sets forth, for the periods indicated, computation of capital adequacy as per Basel II framework.

` in million, except percentages

At

March 31, 2014

At

March 31, 2013

Tier-1 capital ........................................................................................................ 665,400.0 565,615.9

Lower Tier-1 ........................................................................................................ 33,346.2 31,423.0

Tier-2 capital ........................................................................................................ 264,884.5 262,739.2

Upper Tier-2 ......................................................................................................... 152,025.5 146,958.5

Lower Tier-2 subordinated debt ......................................................................... 160,355.5 176,506.1

Total capital .......................................................................................................... 930,284.5 828,355.1

Total risk weighted assets ................................................................................... 4,876,968.1 4,419,435.0

CRAR (%) ............................................................................................................. 19.08% 18.74%

CRAR – Tier-1 capital (%) .................................................................................... 13.65% 12.80%

CRAR – Tier-2 capital (%) .................................................................................... 5.43% 5.94%

Amount raised by issue of Innovative Perpetual Debt Instruments (IPDI) during

the year ................................................................................................................ ——

Amount raised by issue of upper Tier-2 Instruments during the year .............. ——

Amount of subordinated debt raised as Tier-2 capital during the year ............ —38,000.0

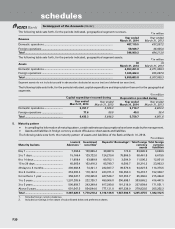

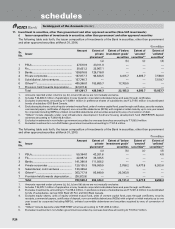

4. Information about business and geographical segments

Business Segments

Pursuant to the guidelines issued by RBI on Accounting Standard 17-(Segment Reporting)- Enhancement of Disclosures

dated April 18, 2007, effective from year ended March 31, 2008, the following business segments have been reported.

•Retail Banking includes exposures which satisfy the four criteria of orientation, product, granularity and low value

of individual exposures for retail exposures laid down in Basel Committee on Banking Supervision document

“International Convergence of Capital Measurement and Capital Standards: A Revised Framework”.

•Wholesale Banking includes all advances to trusts, partnership firms, companies and statutory bodies, which are

not included under Retail Banking.

forming part of the Accounts (Contd.)

schedules