ICICI Bank 2014 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F44

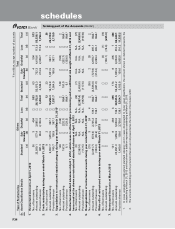

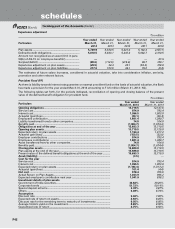

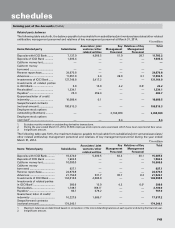

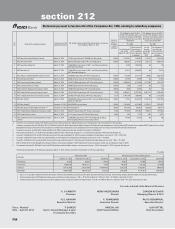

37. Deferred tax

At March 31, 2014, the Bank has recorded net deferred tax asset of ` 7,468.6 million (March 31, 2013: ` 24,793.0 million),

which has been included in other assets.

The following table sets forth, for the periods indicated, the break-up of deferred tax assets and liabilities into major

items.

` in million

At

March 31, 2014

At

March 31, 2013

Deferred tax asset

Provision for bad and doubtful debts .................................................................. 27,621.5 27,146.3

Capital loss ............................................................................................................ 49.6 63.1

Others ................................................................................................................... 2,196.7 2,265.4

Total deferred tax asset ....................................................................................... 29,867.8 29,474.8

Deferred tax liability

Special Reserve deduction1 ................................................................................. 17,234.9 —

Depreciation on fixed assets ................................................................................ 5,172.3 4,682.5

Total deferred tax liability ................................................................................... 22,407.3 4,682.5

Deferred tax asset/(liability) pertaining to foreign branches .............................. 8.1 0.7

Total net deferred tax asset/(liability) ................................................................ 7,468.6 24,793.0

1. The Bank creates Special Reserve through appropriation of profits, in order to avail tax deduction as per Section 36(1)(viii) of

the Income Tax Act, 1961. The Reserve Bank of India, through its circular dated December 20, 2013, advised banks to create

deferred tax liability (DTL) on the amount outstanding in Special Reserve, as a matter of prudence. In accordance with these RBI

guidelines, the Bank has created DTL of ` 14,192.3 million on Special Reserve outstanding at March 31, 2013, by reducing the

reserves. Further, the tax expense for the year ended March 31, 2014 is higher by ` 3,042.6 million due to creation of DTL on

amount appropriated to Special Reserve for the year ended March 31, 2014.

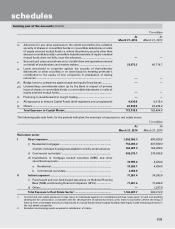

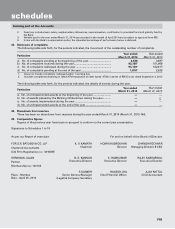

38. Dividend distribution tax

Dividend received from Indian subsidiaries, on which dividend distribution tax has been paid by the Indian subsidiaries

and dividend received from offshore subsidiaries, on which tax has been paid under section 115BBD of the Income Tax

Act, 1961, has been reduced from dividend to be distributed by the Bank for the purpose of computation of dividend

distribution tax as per section 115-O of the Income Tax Act, 1961.

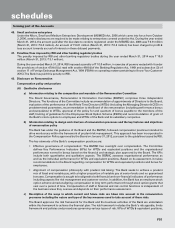

39. Related Party Transactions

The Bank has transactions with its related parties comprising subsidiaries, associates/joint ventures/other related entities,

key management personnel and relatives of key management personnel.

Subsidiaries

ICICI Bank UK PLC, ICICI Bank Canada, ICICI Bank Eurasia Limited Liability Company, ICICI Prudential Life Insurance

Company Limited, ICICI Lombard General Insurance Company Limited, ICICI Prudential Asset Management Company

Limited, ICICI Securities Limited, ICICI Securities Primary Dealership Limited, ICICI Home Finance Company Limited,

ICICI Venture Funds Management Company Limited, ICICI International Limited, ICICI Trusteeship Services Limited, ICICI

Investment Management Company Limited, ICICI Securities Holdings Inc., ICICI Securities Inc., ICICI Prudential Trust

Limited and ICICI Prudential Pension Funds Management Company Limited.

Associates/joint ventures/other related entities

ICICI Equity Fund1, ICICI Eco-net Internet and Technology Fund1 (up to December 31, 2013), ICICI Emerging Sectors Fund1 (up

to December 31, 2013), ICICI Strategic Investments Fund1, ICICI Kinfra Limited1, FINO PayTech Limited, TCW/ICICI Investment

Partners Limited (up to June 30, 2013), I-Process Services (India) Private Limited, NIIT Institute of Finance, Banking and Insurance

Training Limited, ICICI Venture Value Fund1 (up to September 30, 2013), Comm Trade Services Limited, ICICI Foundation for

Inclusive Growth, I-Ven Biotech Limited1, Rainbow Fund (up to December 31, 2013), ICICI Merchant Services Private Limited,

Mewar Aanchalik Gramin Bank and India Infradebt Limited2.

1. Entities consolidated as per Accounting Standard (AS) 21 on ‘Consolidated Financial Statements’.

2. This entity was incorporated and identified as a related party during the three months ended December 31, 2012.

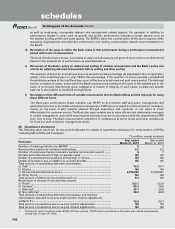

Key management personnel

Chanda Kochhar, N. S. Kannan, K. Ramkumar, Rajiv Sabharwal.

forming part of the Accounts (Contd.)

schedules