ICICI Bank 2014 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F38

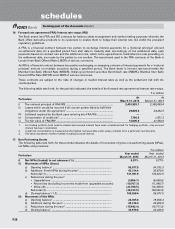

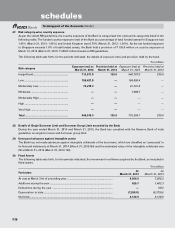

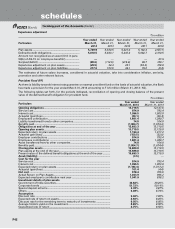

27. Risk category-wise country exposure

As per the extant RBI guidelines, the country exposure of the Bank is categorised into various risk categories listed in the

following table. The funded country exposure (net) of the Bank as a percentage of total funded assets for Singapore was

1.45% (March 31, 2013: 1.45%) and United Kingdom was 0.79% (March 31, 2013: 1.34%). As the net funded exposure

to Singapore exceeds 1.0% of total funded assets, the Bank held a provision of ` 135.0 million on country exposure at

March 31, 2014 (March 31, 2013: ` 230.0 million) based on RBI guidelines.

The following table sets forth, for the periods indicated, the details of exposure (net) and provision held by the bank.

` in million

Risk category Exposure (net) at

March 31, 2014

Provision held at

March 31, 2014

Exposure (net) at

March 31, 2013

Provision held at

March 31, 2013

Insignificant ................................................ 713,811.9 135.0 546,787.0 230.0

Low ............................................................. 158,427.8 — 184,890.4 —

Moderately Low ......................................... 73,278.3 — 41,721.0 —

Moderate.................................................... — — 1,906.7 —

Moderately High ........................................ — — — —

High ............................................................ — — — —

Very High ................................................... — — — —

Total ........................................................... 945,518.0 135.0 775,305.1 230.0

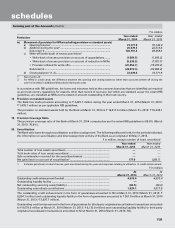

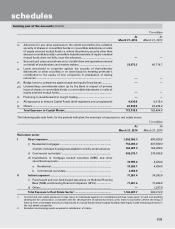

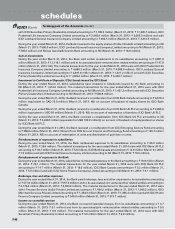

28. Details of Single Borrower Limit and Borrower Group Limit exceeded by the Bank

During the year ended March 31, 2014 and March 31, 2013, the Bank has complied with the Reserve Bank of India

guidelines on single borrower and borrower group limit.

29. Unsecured advances against intangible assets

The Bank has not made advances against intangible collaterals of the borrowers, which are classified as ‘unsecured’ in

its financial statements at March 31, 2014 (March 31, 2013:Nil) and the estimated value of the intangible collaterals was

Nil at March 31, 2014 (March 31, 2013: Nil).

30. Fixed Assets

The following table sets forth, for the periods indicated, the movement in software acquired by the Bank, as included in

fixed assets.

` in million

Particulars At

March 31, 2014

At

March 31, 2013

At cost at March 31st of preceding year .............................................................. 8,508.0 7,055.2

Additions during the year ..................................................................................... 925.7 1,462.3

Deductions during the year .................................................................................. —(9.5)

Depreciation to date .............................................................................................. (7,298.8) (6,379.5)

Net block ................................................................................................................ 2,134.9 2,128.5

forming part of the Accounts (Contd.)

schedules