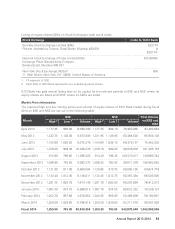

ICICI Bank 2014 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4242

ECONOMIC OUTLOOK

Fiscal 2014 was a challenging year for the Indian economy, with continued moderation in economic

growth, persistent inflation, high interest rates and significant volatility in global and domestic financial

markets. ICICI Bank calibrated its strategy to the environment, adopting a balanced approach to growth,

profitability and risk management. We believe that India continues to have strong drivers for growth

over the medium-to-long term, underpinned by its infrastructure and industrial investment potential and

demographic advantage. We continue to focus on enhancing our capabilities to capitalise on the growth

opportunities arising from the Indian economy and its international linkages.

For a detailed discussion of economic developments in fiscal 2014, please refer “Management’s

Discussion & Analysis”.

BUSINESS REVIEW

Retail Banking

The preferences of Indian consumers are evolving rapidly with the increasing penetration of technology in

the area of banking. New products, new channels and new service experiences are shaping the banking

landscape of the future. ICICI Bank has always been a pioneer in the area of understanding customer needs

and designing solutions in line with its philosophy of Khayaal Aapka.

The Bank continues its leadership in the area of technology to provide a superior customer experience. A new

channel for banking has been introduced with the launch of the Bank’s Facebook app, ’Pockets from ICICI

Bank’. This app allows customers to fulfil all banking needs while socialising with friends and relatives on

Facebook. The Bank also upgraded its retail internet banking platform to enable a superior online experience.

This platform allows users to personalise the home page so that all required information is visible with

minimal clicks. Similarly, the Bank has taken a number of steps to empower customers at branches, including

transaction kiosks and cash acceptance machines that enable them to undertake transactions on their own.

The Bank has also scaled up the number of its 24x7 Touch Banking branches to 101 in 33 cities.

Through Tab Banking, the Bank’s executives now assist customers in opening a bank account from the comfort

of their homes and offices. The documentation required from customers is minimal since our executives use

tablets to click photographs of the customers and also scan their documents. Tab Banking has generated high

interest from prospective customers, demonstrating the success of this proposition. The Bank now plans to

extend its journey of using tablets and digitisation to home loans and vehicle loans.

ICICI Bank has also brought various new products to Indian consumers. Many Indian consumers have

apprehensions about security of online transactions. ICICI Bank, in partnership with Visa, has introduced Carbon,

Asia’s first credit card powered by Visa CodeSure, making the card one of the safest for any usage, especially fo

r

Business Overview