ICICI Bank 2014 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F15

Monetary foreign currency assets and liabilities of domestic and integral foreign operations are translated at closing

exchange rates notified by Foreign Exchange Dealers’ Association of India (FEDAI) relevant to the balance sheet date

and the resulting gains/losses are included in the profit and loss account.

Both monetary and non-monetary foreign currency assets and liabilities of non-integral foreign operations are translated

at closing exchange rates notified by FEDAI relevant to the balance sheet date and the resulting gains/losses from

exchange differences are accumulated in the foreign currency translation reserve until the disposal of the net investment

in the non-integral foreign operations. On the disposal/partial disposal of a non-integral foreign operation, the cumulative/

proportionate amount of the exchange differences which has been accumulated in the foreign currency translation

reserve and which relates to that operation are recognised as income or expenses in the same period in which the gain

or loss on disposal is recognised.

The premium or discount arising on inception of forward exchange contracts that are entered into to establish the

amount of reporting currency required or available at the settlement date of a transaction is amortised over the life of the

contract. All other outstanding forward exchange contracts are revalued based on the exchange rates notified by FEDAI

for specified maturities and at interpolated rates for contracts of interim maturities. The contracts of longer maturities

where exchange rates are not notified by FEDAI are revalued based on the forward exchange rates implied by the swap

curves in respective currencies. The resultant gains or losses are recognised in the profit and loss account.

Contingent liabilities on account of guarantees, endorsements and other obligations denominated in foreign currencies

are disclosed at the closing exchange rates notified by FEDAI relevant to the balance sheet date.

7. Accounting for derivative contracts

The Bank enters into derivative contracts such as foreign currency options, interest rate and currency swaps, credit

default swaps and cross currency interest rate swaps.

The swap contracts entered to hedge on-balance sheet assets and liabilities are structured such that they bear an

opposite and offsetting impact with the underlying on-balance sheet items. The impact of such derivative instruments

is correlated with the movement of underlying assets and liabilities and accounted pursuant to the principles of hedge

accounting. Hedged swaps are accounted for on an accrual basis.

Foreign currency and rupee derivative contracts entered into for trading purposes are marked to market and the resulting

gain or loss (net of provisions, if any) is accounted for in the profit and loss account. Pursuant to RBI guidelines, any

receivables under derivative contracts which remain overdue for more than 90 days and mark-to-market gains on other

derivative contracts with the same counter-parties are reversed through profit and loss account.

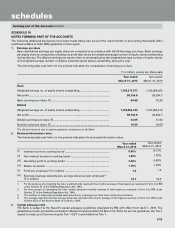

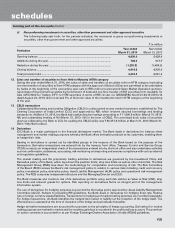

8. Employee Stock Option Scheme (ESOS)

The Employees Stock Option Scheme (the Scheme) provides for grant of options on the Bank’s equity shares to

wholetime directors and employees of the Bank and its subsidiaries. The Scheme provides that employees are granted

an option to subscribe to equity shares of the Bank that vest in a graded manner. The options may be exercised within

a specified period. The Bank follows the intrinsic value method to account for its stock-based employee compensation

plans. Compensation cost is measured as the excess, if any, of the fair market price of the underlying stock over the

exercise price on the grant date and amortised over the vesting period. The fair market price is the latest closing price,

immediately prior to the grant date, which is generally the date of the Board of Directors meeting in which the options

are granted, on the stock exchange on which the shares of the Bank are listed. If the shares are listed on more than one

stock exchange, then the stock exchange where there is highest trading volume on the said date is considered.

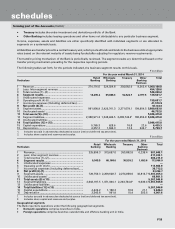

9. Staff Retirement Benefits

Gratuity

The Bank pays gratuity to employees who retire or resign after a minimum prescribed period of continuous service

and in case of employees at overseas locations as per the rules in force in the respective countries. The Bank makes

contribution to a trust which administers the funds on its own account or through insurance companies.

The actuarial gains or losses arising during the year are recognised in the profit and loss account.

Actuarial valuation of the gratuity liability is determined by an actuary appointed by the Bank. Actuarial valuation of

gratuity liability is determined based on certain assumptions regarding rate of interest, salary growth, mortality and staff

attrition as per the projected unit credit method.

Superannuation Fund

The Bank contributes 15.00% of the total annual basic salary of certain employees to superannuation funds managed

and administered by insurance companies for its employees. The Bank also gives an option to its employees, allowing

them to receive the amount contributed by the Bank along with their monthly salary during their employment.

The amount so contributed/paid by the Bank to the superannuation fund or to employee during the year is recognised

in the profit and loss account.

Pension

The Bank provides for pension, a defined benefit plan covering eligible employees of erstwhile Bank of Madura, erstwhile

Sangli Bank and erstwhile Bank of Rajasthan. The Bank makes contribution to a trust which administers the funds on its

own account or through insurance companies. The plan provides for pension payment including dearness relief on a

monthly basis to these employees on their retirement based on the respective employee’s years of service with the Bank

and applicable salary.

forming part of the Accounts (Contd.)

schedules