ICICI Bank 2014 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F57

independent auditors’ report

ended March 31, 2014. These financial statements have been audited by other auditors, duly qualified to act as auditors

in the country of incorporation of the said branches, whose reports have been furnished to us, and our opinion is based

solely on the report of other auditors.

We have also relied on the un-audited financial statements of certain subsidiaries, associates and joint ventures, whose

financial statements reflect total assets of ` 21,983 million as at March 31, 2014, total revenues of ` 8,302 million and

net cash out flows amounting to ` 2,156 million for the year then ended.

We have jointly audited, with other auditor, the financial statements of subsidiary which reflect total assets of ` 816,826

million as at March 31, 2014, total revenue of ` 159,902 million and net cash out flows amounting to ` 7,300 million for

the year then ended. For the purpose of the consolidated financial statements, we have relied upon the work of other

auditors.

The auditors of the ICICI Prudential Life Insurance Company, the ICICI Group’s life insurance subsidiary have reported,

“The actuarial valuation of liabilities for life policies in force is the responsibility of the Company’s Appointed Actuary

(the ‘Appointed Actuary’). The actuarial valuation of these liabilities for life policies in force and for policies in respect of

which premium has been discontinued but liability exists as at March 31, 2014 has been duly certified by the Appointed

Actuary and in his opinion, the assumptions for such valuation are in accordance with the guidelines and norms issued

by the Insurance Regulatory and Development Authority (‘IRDA’) and the Institute of Actuaries of India in concurrence

with the IRDA. We have relied upon the Appointed Actuary’s certificate in this regard for forming our opinion on the

valuation of liabilities for life policies in force and for policies in respect of which premium has been discontinued but

liability exists on financial statements of the Company”.

The auditors of the ICICI Lombard General Insurance Company Limited, the ICICI Group’s general insurance subsidiary

have reported, “The actuarial valuation of liabilities in respect of Incurred But Not Reported (‘IBNR’) and Incurred But

Not Enough Reported (‘IBNER’) as at March 31, 2014, other than for reinsurance accepted from Decline Risk Pool (‘DR

Pool’), has been duly certified by the Appointed Actuary of the Company and relied upon by us. The Appointed Actuary

has also certified that the assumptions considered by him for such valuation are in accordance with the guidelines

and norms prescribed by the IRDA and the Actuarial Society of India in concurrence with the IRDA. In respect of

reinsurance accepted from DR Pool, IBNR/IBNER has been recognized based on the estimates received from DR Pool”.

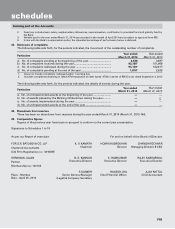

For S.R. BATLIBOI & CO. LLP

ICAI Firm registration number: 301003E

Chartered Accountants

per Shrawan Jalan

Partner

Membership No.: 102102

Place: Mumbai

Date: April 25, 2014