ICICI Bank 2003 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

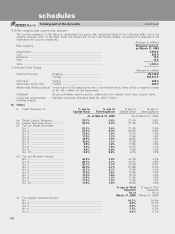

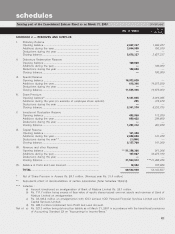

F34

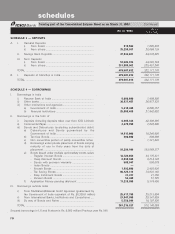

SCHEDULE 3 — DEPOSITS

A. I. Demand Deposits

i) From banks ................................................................. 919,592 1,089,978

ii) From others ................................................................. 35,259,501 26,088,139

II. Savings Bank Deposits ........................................................ 37,932,081 24,970,029

III. Term Deposits

i) From banks ................................................................. 53,585,875 44,565,784

ii) From others ................................................................. 351,809,963 225,457,240

TOTAL ............................................................................................ 479,507,012 322,171,170

B. I. Deposits of branches in India ............................................. 479,507,012 322,171,170

TOTAL ............................................................................................ 479,507,012 322,171,170

SCHEDULE 4 — BORROWINGS

I. Borrowings in India

i) Reserve Bank of India ......................................................... 8,000,000 1,408,900

ii) Other banks .......................................................................... 36,837,487 26,877,535

iii) Other institutions and agencies ..........................................

a) Government of India ................................................... 5,210,408 6,009,357

b) Financial Institutions ................................................... 25,658,489 21,842,092

II. Borrowings in the form of

i) Deposits (including deposits taken over from ICICI Limited) 6,665,336 42,499,895

ii) Commercial Paper ................................................................ 2,270,700 7,022,886

iii) Bonds and Debentures (excluding subordinated debt)

a) Debentures and Bonds guaranteed by the

Government of India ................................................... 14,815,000 18,240,000

b) Tax free Bonds ............................................................ 800,000 800,000

c) Non convertible portion of partly convertible notes —1,331,936

d) Borrowings under private placement of bonds carrying

maturity of one to thirty years from the date of

placement .................................................................... 91,289,109 193,569,377

e) Bonds Issued under multiple option/safety bonds series

- Regular Interest Bonds .......................................... 16,722,052 34,175,231

- Deep Discount Bonds ............................................ 6,098,808 6,214,122

- Bonds with premium warrants ............................. 588,947 506,078

- Index Bonds ........................................................... ——

- Encash Bonds ........................................................ 1,892,690 2,493,030

- Tax Saving Bonds ................................................... 80,125,313 74,933,163

- Easy Instalment Bonds .......................................... 31,337 31,359

- Pension Bonds ....................................................... 54,469 51,729

f) Application Money pending allotment ...................... 11,238,896 5,374,495

III. Borrowings outside India

i) From Multilateral/Bilateral Credit Agencies (guaranteed by

the Government of India equivalent of Rs. 20,335.6 million) 25,417,795 25,213,694

ii) From International Banks, Institutions and Consortiums .... 27,947,995 29,347,659

iii) By way of Bonds and Notes .............................................. 5,550,996 18,197,520

TOTAL ............................................................................................ 367,215,827 516,140,058

Secured borrowings in I, II and III above is Rs. 8,000 million (Previous year Rs. Nil)

(Rs. in ‘000s) As on

31.03.2002

schedules

forming part of the Consolidated Balance Sheet as on March 31, 2003

Continued