ICICI Bank 2003 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion & Analysis

53

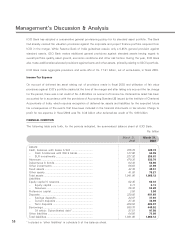

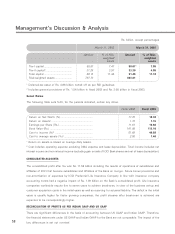

Net Interest Income and Spread Analysis

Rs. billion, except percentages

Fiscal 2002 Fiscal 2003

Average interest-earning assets ................................. 222.39 905.16

Interest income ............................................................ 21.52 92.391

Average interest-bearing liabilities .............................. 207.37 891.62

Total interest expenses ............................................... 15.59 79.44

Net interest income ..................................................... 5.93 12.95

Net interest margin ..................................................... 2.67% 1.43%

Average yield (1) .......................................................... 9.68% 10.21%

Average cost of funds (2) ........................................... 7.52% 8.91%

Average cost of deposits ............................................. 7.28% 6.77%

Yield spread (1) – (2) .................................................... 2.16% 1.30%

1 Excluding dividend income of Rs. 1.29 billion.

The total interest income increased to Rs. 92.39 billion (excluding all dividend income) in fiscal 2003 compared

to Rs. 21.52 billion in fiscal 2002, due to an increase in the average volume of interest-earning assets to

Rs. 905.16 billion in fiscal 2003 from Rs. 222.39 billion in fiscal 2002. The yield on average interest earning

assets was 10.21% for fiscal 2003 compared to 9.68% for fiscal 2002. The increase in yield was primarily

on account of the higher-yielding loan portfolio of ICICI transferred to the Bank on merger. This was offset

by the increase in lower-yielding Government securities portfolio and cash reserves with RBI, in compliance

with Statutory Liquidity Ratio (SLR) and Cash Reserve Ratio (CRR) requirements on ICICI’s outstanding

liabilities transferred to the Bank on merger. The average volume of investment in Government securities

increased by about Rs. 161.50 billion to Rs. 246.19 billion in fiscal 2003. ICICI Bank reduces the amortisation

of premium on SLR investments in the “Held-to-Maturity” category from the interest income. This amortisation

charge was Rs. 1.36 billion for fiscal 2003. ICICI Bank also reduces Direct Marketing Agent (DMA) commissions

on auto loans from the interest income. These commissions are expensed upfront and not amortised. The

auto DMA commissions reduced from the interest income in fiscal 2003 were Rs. 1.57 billion. Interest

income also includes Rs. 0.24 billion of interest on Income-tax refund.

During fiscal 2003, the Bank adopted a new accounting policy for non-accrual of income on certain loans,

including assistance to projects under implementation where the implementation has been significantly

delayed and, in the opinion of the management, significant uncertainties exist as to the final financial closure

and/or date of completion of the project; although such non-accrual is not required by RBI norms. Dividend

income (other than from subsidiaries) of Rs. 1.29 billion (including Rs. 0.53 billion of dividend income from

mutual fund units) is included in interest income in accordance with RBI norms, but is excluded for the

purpose of spread analysis.