ICICI Bank 2003 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F16

forming part of the Accounts Continued

schedules

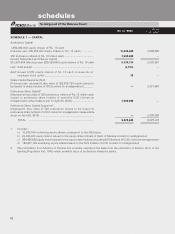

Deferred tax assets and liabilities are recognised for the future tax consequences of temporary differences arising

between the carrying values of assets and liabilities and their respective tax basis and operating carry forward losses.

Deferred tax assets are recognised only after giving due consideration to prudence. Deferred tax asset and liabilities

are measured using tax rates and tax laws that have been enacted or substantially enacted by the balance sheet date.

The impact on account of changes in the deferred tax assets and liabilities is also recognised in the income statement.

Deferred tax assets are recognised based upon management’s judgement as to whether realisation is considered

reasonably certain.

10. Translation of the Financial Statements of Foreign Representative Offices

In accordance with the guidelines issued by the Reserve Bank of India, all assets, liabilities, income and expenditure of the

foreign representative offices of the Bank have been converted at the closing rate prevailing on the balance sheet date.

B.B.

B.B.

B. NOTES FORMING PART OF THE ACCOUNTS

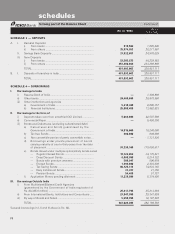

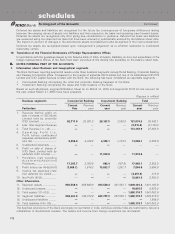

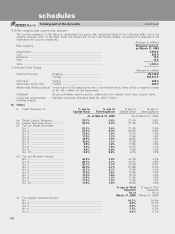

1. Information about Business and Geographical segments

The Bank had been reporting segmental results under three business segments namely Retail Banking, Corporate Banking

and Treasury & Corporate office. Consequent to the merger of erstwhile ICICI Limited and two of its subsidiaries ICICI PFS

Limited and ICICI Capital Services Limited with the Bank, the following has been considered as reportable segments :

• Commercial Banking comprising the retail and corporate banking business of the Bank.

• Investment Banking comprising the rupee and forex treasury of the Bank

Based on such allocations, segmental Balance Sheet as on March 31, 2003 and segmental Profit & Loss account for

the year ended March 31, 2003 have been prepared.

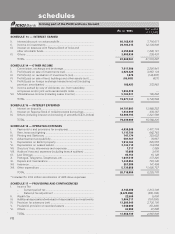

(Rupees in million)

Business segments Commercial Banking Investment Banking Total

Current Previous Current Previous Current Previous

Particulars Year year year year year year

1. Revenue (before profit on

sale of shares of ICICI Bank

Limited held by erstwhile

ICICI Limited) ....................... 92,717.0 22,891.2 29,157.5 7,550.9 121,874.5 30,442.1

2. Less: Inter segment Revenue ————(8,515.6) (3,176.2)

3. Total Revenue (1) – (2) ........ ————113,358.9 27,265.9

4. Operating Profit (i.e.

Profit before unallocated

expenses, extraordinary profit,

and tax) ................................ 9,456.0 4,326.2 4,346.1 1,124.5 13,802.1 5,450.9

5. Unallocated expenses ......... ——————

6. Profit on sale of shares of

ICICI Bank Limited held by

erstwhile ICICI Limited........ ——11,910.0 —11,910.0 —

7. Provisions (net) including

Accelerated/Additional

Provisions ............................. 17,305.7 2,709.9 602.4 (157.0) 17,908.1 2,552.9

8. Profit before tax (4)-(5)-(6)-(7) (7,849.7) 1,616.3 15,653.7 1,281.7 7,804.0 2,898.0

9. Income tax expenses (net)/

(net deferred tax credit) ...... ————(4,257.8) 315.0

10. Net Profit (8)-(9) ................... — ——— 12,061.8 2,583.0

Other Information

11. Segment assets .................. 685,550.8 669,889.9 363,550.4 361,303.1 1,049,101.2 1,031,193.0

12. Unallocated assets .............. ————19,018.5 9,870.0

13. Total assets (11)+(12) ......... ————1,068,119.7 1,041,063.0

14. Segment liabilities ............... 800,361.9 742,014.9 267,757.8 297,500.1 1,068,119.7 1,039,515.0

15. Unallocated liabilities .......... —————1,548.0

16. Total liabilities (14)+(15) ...... ————1,068,119.7 1,041,063.0

The business operations of the Bank are largely concentrated in India. Activities outside India are restricted to resource

mobilisation in international markets. The assets and income from foreign operations are immaterial.