ICICI Bank 2003 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F44

schedules

forming part of the Consolidated Accounts Continued

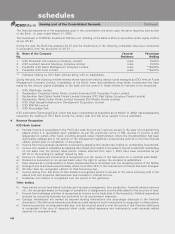

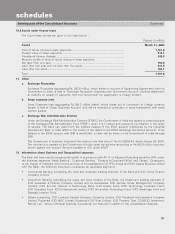

11. Staff benefits

For employees covered under group gratuity scheme and group superannuation scheme of LIC, gratuity and

superannuation charged to Profit and Loss Account is on the basis of premium charged by LIC. Provision for gratuity

and pension for other employees and leave encashment liability is determined as per actuarial valuation. Defined

contributions for Provident Fund are charged to the Profit and Loss Account based on contributions made in terms of

the scheme.

12. Income Tax

Income tax expense is the aggregate amount of current tax and deferred tax charge. Taxes on income are accrued

in the same period as the revenue and expenses to which they relate. Current period taxes are determined in

accordance with the Income Tax Act, 1961. Deferred tax adjustments comprise of changes in the deferred tax assets

or liabilities during the year.

Deferred tax assets and liabilities are recognised for the future tax consequences of temporary differences arising

between the carrying values of assets and liabilities and their respective tax basis and operating carry forward losses.

Deferred tax assets are recognised only after giving due consideration to prudence. Deferred tax assets and liabilities

are measured using tax rates and tax laws that have been enacted or substantially enacted by the balance sheet date.

The impact on account of changes in the deferred tax assets and liabilities is also recognised in the income statement.

Deferred tax assets are recognised based upon management’s judgement as to whether realisation is considered

reasonably certain.

13. Translation of the Financial Statements of Foreign Representative Offices

In accordance with the guidelines issued by the Reserve Bank of India, all assets, liabilities, income and expenditure

of the foreign representative offices of the Bank have been converted at the closing rate prevailing on the balance

sheet date.

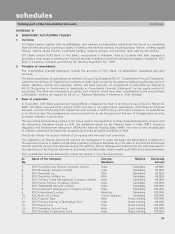

B. NOTES FORMING PART OF THE ACCOUNTS

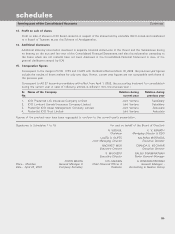

1. Preference Shares

Certain Government Securities amounting to Rs.1,244.8 million (2002 : Rs.1,304.6million) have been earmarked

against redemption of preference share capital, which falls due for redemption on April 20, 2018 as per the original

issue terms.

2. Employee Stock Option Scheme

In terms of Employee Stock Option Scheme, the maximum number of options granted to any Eligible Employee in a

financial year shall not exceed 0.05% of the issued equity shares of the Bank at the time of grant of the options and

aggregate of all such options granted to the Eligible Employees shall not exceed 5% of the aggregate number of the

issued equity shares of the Bank subsequent to the amalgamation of ICICI, I CAPS and I PFS with the Bank and the

issuance of equity shares by the Bank pursuant to the amalgamation of ICICI, I CAPS and I PFS with the Bank.

In terms of the Scheme, 12,610,275 options (2002 : 13,343,625 options) granted to eligible employees were outstanding

as at March 31, 2003.

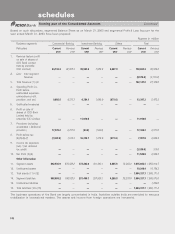

Stock option activity

A summary of the status of the Bank’s option plan is presented below:

Year ended Year ended

March 31, 2003 March 31, 2002

Option shares Option shares

outstanding outstanding

Outstanding at the beginning of the year .............................................. 13,343,625 1,636,125

Add: Granted during the year ................................................................. —4,735,200

Options taken over on Amalgamation ........................................... —* 7,015,800

Less: Forfeited during the year ................................................................ 730,350 43,500

Exercised during the year .............................................................. 3,000 —

Outstanding at the end of the year ........................................................ 12,610,275 13,343,625

* Represents options granted to option holders of erstwhile ICICI Limited in the share swap ratio.