ICICI Bank 2003 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F80

Continued

notes to the consolidated financial statements

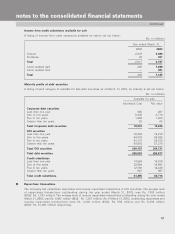

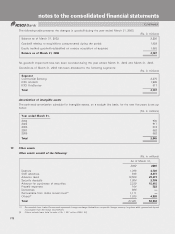

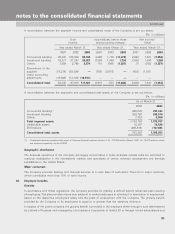

A listing of long-term debt as of March 31, 2003, by maturity and interest rate profile is set out below:

(Rs. in millions)

Fixed-rate Floating-rate

obligations obligations Total

Long-term debt maturing during the year ending March 31,

2004 77,994 8,269 86,263

2005 67,022 2,977 69,999

2006 85,660 6,200 91,860

2007 20,190 5,143 25,333

2008 26,136 1,907 28,043

Thereafter 88,020 13,126 101,146

Total 365,022 37,622 402,644

Less: Unamortized debt issue cost 1,832

Total 400,812

All long-term debt is unsecured. Debt aggregating Rs.35,151million 2002:Rs.40,439million) is guaranteed by

the Government of India (GOI).

Long-term debt is denominated in various currencies. As of March 31, 2003, long-term debt comprises Indian rupee

debt of Rs. 350,633 million (2002: Rs. 438,529million) and foreign currency debt of Rs. 50,179million

(2002: Rs. 72,894million).

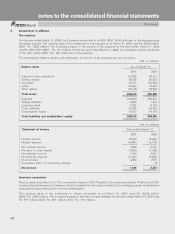

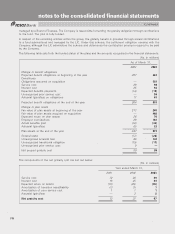

Indian Rupee debt

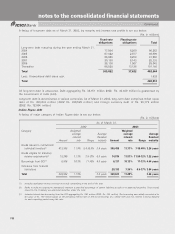

A listing of major category of Indian Rupee debt is set out below:

(Rs. in millions)

As of March 31,

2002 2003

Category Weighted Weighted

average Average average Average

interest Residual interest Residual

Amount rate Range maturity Amount rate Range maturity

Bonds issued to institutional/

individual investors

(1)

413,388 11.9% 8.4-16.5% 3.4 years 309,488 11.71% 7-16.40% 3.26 years

Bonds eligible for statutory

reserve requirements

(2)

18,240 11.3% 7.8-12% 6.8 years 14,815 11.87% 11.50-12% 7.22 years

Borrowings from GOI

(3)

6,936 10.3% 11-16% 4.9 years 6,137 10.13% 11-13% 4.44 years

Refinance from financial

institutions 20,193 7.35% 6.5-17% 3.64 years

Total 438,564 11.9% 3.5 years 350,633 11.28% 3.46 years

(1) Includes application money received on bonds outstanding at the end of the year.

(2) Banks in India are required to mandatorily maintain a specified percentage of certain liabilities as cash or in approved securities. These bonds

issued by the Company are approved securities under the rules.

(3) Includes interest-free borrowing from the GOI aggregating Rs.296million (2002: Rs.255million). The borrowing was initially recorded at its

fair value of Rs.100million based on the prevailing interest rate of 16% for borrowings of a similar term and risk. Interest is being imputed

for each reporting period using this rate.