ICICI Bank 2003 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F45

schedules

forming part of the Consolidated Accounts Continued

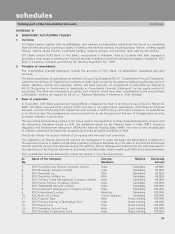

3. Subordinated debt

Subordinated debt includes Index bonds amounting to Rs.95.8million, (2002 : Rs.88.0 million) which carry a detachable

warrant entitling bondholders to a right to receive an amount linked to the BSE Sensitive Index (Sensex) per terms of

the issue. The liability of the Bank arising out of changes in the Sensex has been hedged by earmarking its investments

of an equivalent amount in the UTI Index Equity Fund whose value is based on the Sensex. The Bank has not issued

any subordinated debt during the current year.

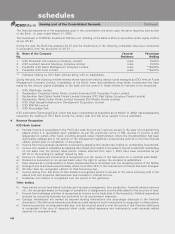

4. Fixed Assets and Depreciation

The Bank depreciated Automatic Teller Machines (‘ATMs’) over its useful life estimated as 6 years or over the lease

period for ATMs taken on lease. Effective April 1, 2002 the Bank revised the useful life of the ATMs to 8 years based

on an evaluation done by the management.

Accordingly, the depreciation charged for the current year was lower by Rs.29.0 million.

5. Investments

Effective April1, 2002, the Bank has changed the methodology for ascertaining the carrying cost of fixed income

bearing securities from Weighted Average Method to First-In-First-Out Method. The impact due to the aforementioned

change on the Profit and Loss Account for the year ended March 31, 2003 has resulted into a profit amounting to

Rs. 132.2 million.

Investments include shares and debentures amounting to Rs. 3,781.9 million which are in the process of being

registered in the name of the Bank. For ICICI Emerging Sectors Fund and ICICI Equity Fund, such investments

amounted to Rs. 1,991.3 million and Rs. 1,683.2 million respectively.

Investments also include government securities amounting to Rs. 703.5 million (representing face value of securities)

pledged with certain banks and institutions for cheque drawal and clearing facilities.

6. Repurchase Transactions

During the current year, the Bank has changed its method of accounting repurchase transactions and reverse repurchase

transactions. These transactions have been accounted for as a sale and forward purchase or purchase and a forward

sale transactions in the current year as against a borrowing or lending transaction in the previous year. The net impact

of the same on the profit and loss account is not material.

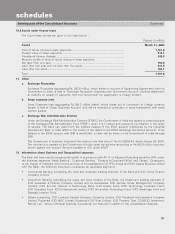

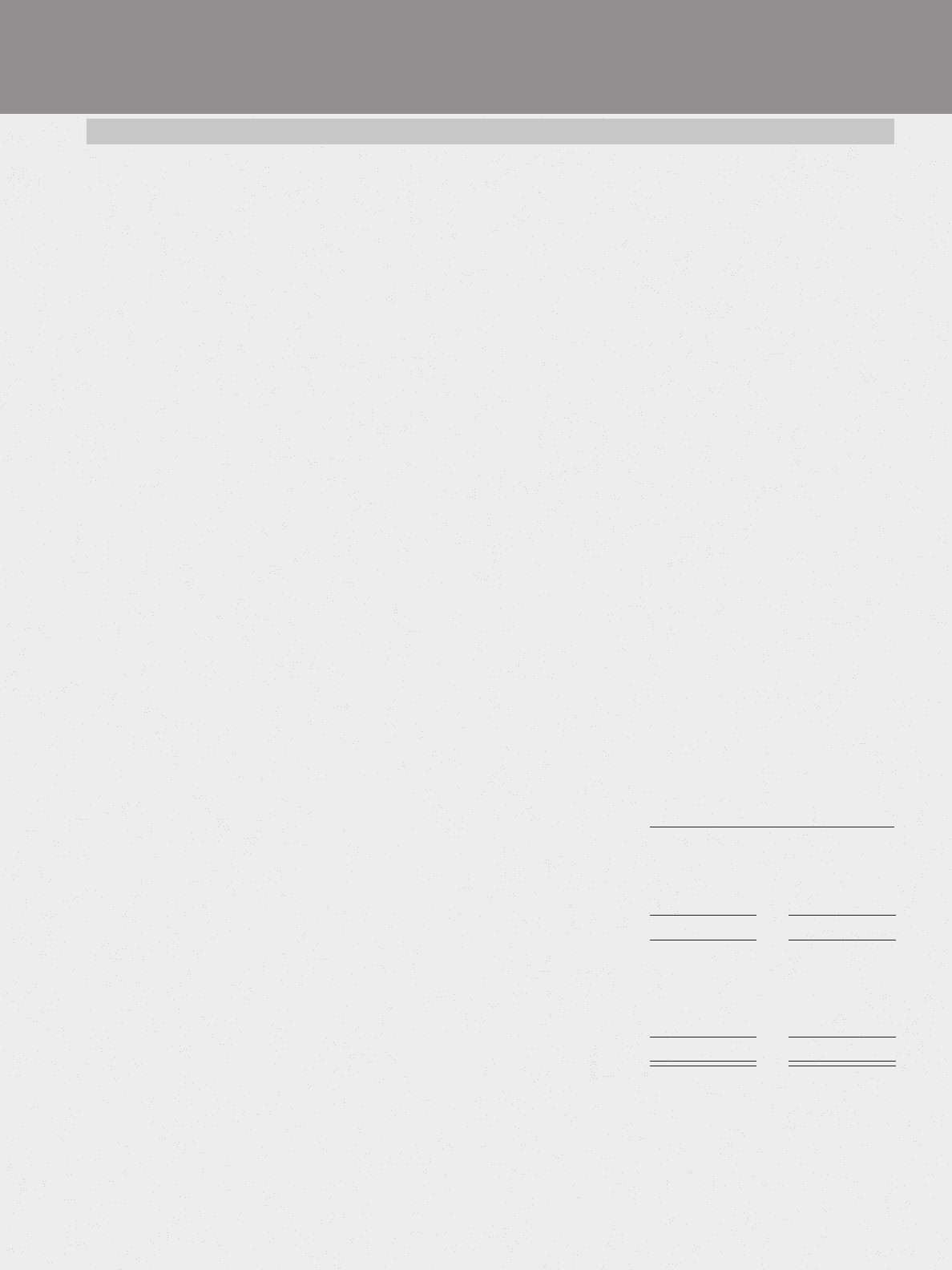

7. Deferred Tax

On March 31, 2003, the Group has recorded net deferred tax asset of Rs. 5,053.9million, (2002 : Deferred tax liability

of Rs. 1,470.5 million) which has been included in other assets.

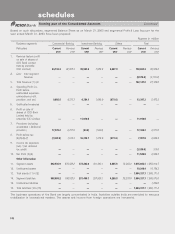

A composition of deferred tax assets and liabilities into major items is given below :

Rupees in million

Particulars March 31, 2003 March 31, 2002

Amortisation of premium on investments .............................................. 527.4 85.2

Provision for bad and doubtful debts...................................................... 13,164.1 7,144.8

Others ........................................................................................................ 879.3 1,430.1

14,570.8 8,660.1

Less: Deferred Tax Liability

Depreciation on fixed assets ................................................................... 9,275.0 9,938.3

Others ........................................................................................................ 241.9 192.3

9,516.9 10,130.6

Net Deferred Tax Asset/(Liability) ............................................................. 5,053.9 (1,470.5)