ICICI Bank 2003 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F81

Continued

notes to the consolidated financial statements

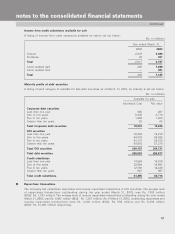

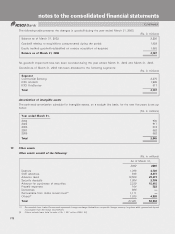

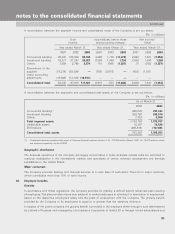

Foreign currency debt

A listing of major category of foreign currency debt is set out below:

(Rs. in millions)

As of March 31,

2002 2003

Category Weighted Weighted

average Average average Average

interest Residual interest Residual

Amount rate Range maturity Amount rate Range maturity

Borrowings from international

development agencies

(1) (2) (3)

25,224 3.0% 0-6.8% 13.6 years 25,417 4.14% 0-8.5% 9.50 years

Other borrowings from

international markets 47,670 3.8% 2-9.1% 2.1 years 24,762 3.37% 0-9.15% 2.52 years

Total 72,894 3.5% 6.08 years 50,179 3.69% 6.05 years

(1) These borrowings have been raised under specific lines of credit from international development agencies. The borrowings have lender-imposed

restrictions that limit the use of the funds for specified purposes, which include lending to specified sectors.

(2) As of March 31, 2003, under these lines of credit, the Company has an unutilized option to borrow Rs.6,265million (2002:Rs.5,349million)

as per an agreed schedule over a period of 5 years at various interest rates.

(3) Exchange rate fluctuations on certain borrowings are guaranteed by the GOI.

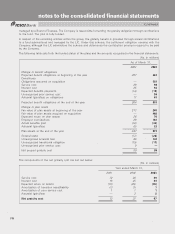

Redeemable preferred stock

The Company issued preferred stock with a face value of Rs. 3,500million during the year ended March31, 1998

under the scheme of business combination with ITC Classic Finance Limited. This preferred stock bears a dividend

yield of 0.001% and is redeemable at face value after 20years. The preferred stock was initially recorded at its

fair value of Rs.466million. Subsequently, interest is being imputed for each reporting period. The imputed

interest rate of 10.6% was determined based on the then prevailing interest rate for securities of similar maturity.

The carrying amount of this redeemable preferred stock as of March 31, 2003 is Rs.853million (2002:

Rs. 772million).

Banks in India are not allowed to issue preferred stock. However, the Company has been currently exempted from

the restriction, which prohibits issue of preference shares by banks.

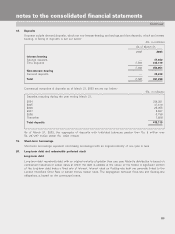

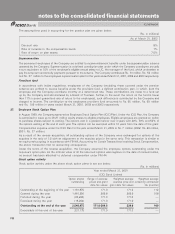

21. Other liabilities

Interest accrued

Other liabilities as of March 31, 2003, include Rs. 16,276 million (2002: Rs. 21,435million) of interest accrued but

not due on interest bearing liabilities.

Borrowings from Kreditanstalt fur Wiederaufbau

The Company has been borrowings from Kreditanstalt fur Wiederaufbau (KfW), an international development agency,

under specific lines of credit. The terms of the borrowings provide for limitations on usage, whereby funds can be

used only for specified purposes. The borrowings are guaranteed by the GOI.

With respect to certain borrowings, the terms of the borrowing agreement provide that a portion of the interest

payable on the borrowing shall be paid to the GOI instead of the lender. KfW and the GOI have entered into an

agreement whereby the interest paid to the GOI is repaid to the Company either in the form of a grant or a loan.

While the loan is repayable as per a specified schedule, the grants do not have a repayment schedule. The interest

amounts received from the GOI bear limitations on usage and are required to be advanced as loans/contributions

for specified purposes. Similarly, with respect to certain other borrowings from KfW, the terms of the borrowing

agreement provide that a portion of the interest payable on the borrowings shall be retained by the Company and

used to be advanced as loans/contributions for specified purposes.