ICICI Bank 2003 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

Directors’ Report

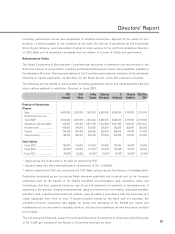

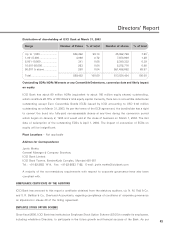

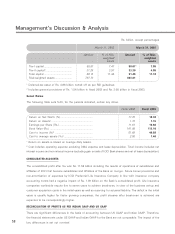

Distribution of shareholding of ICICI Bank at March 31, 2003

Range Number of Folios % of total Number of shares % of total

Up to 1,000 ....................... 564,492 99.14 45,992,798 7.50

1,001-5,000 ........................ 4,066 0.72 7,870,906 1.28

5,001-10,000 ...................... 341 0.06 2,399,332 0.39

10,001-50,000 .................... 253 0.04 5,272,716 0.86

50,001 & above ................. 250 0.04 551,498,652 89.97

Total ................................... 569,402 100.00 613,034,404 100.00

Outstanding GDRs/ADRs/Warrants or any Convertible Debentures, conversion date and likely impact

on equity

ICICI Bank has about 80 million ADRs (equivalent to about 160 million equity shares) outstanding,

which constitute 26.10% of ICICI Bank’s total equity capital. Currently, there are no convertible debentures

outstanding except Euro Convertible Bonds (ECB) issued by ICICI amounting to USD 0.40 million

outstanding as on March 31, 2003. As per the terms of the ECB agreement, the bondholder has a right

to convert the bond into fully-paid non-assessable shares at any time during the conversion period

which began on January 2, 1994 and would end at the close of business on March 1, 2004. The last

date of redemption of the outstanding ECBs is April 1, 2004. The impact of conversion of ECBs on

equity will be insignificant.

Plant Locations – Not applicable

Address for Correspondence

Jyotin Mehta

General Manager & Company Secretary

ICICI Bank Limited

ICICI Bank Towers, Bandra-Kurla Complex, Mumbai 400 051

A majority of the non-mandatory requirements with respect to corporate governance have also been

complied with.

COMPLIANCE CERTIFICATE OF THE AUDITORS

ICICI Bank has annexed to this report a certificate obtained from the statutory auditors, viz. N. M. Raiji & Co.

and S. R. Batliboi & Co., Chartered Accountants, regarding compliance of conditions of corporate governance

as stipulated in clause 49 of the listing agreement.

EMPLOYEE STOCK OPTION SCHEME

Since fiscal 2000, ICICI Bank has instituted an Employee Stock Option Scheme (ESOS) to enable its employees,

including wholetime Directors, to participate in the future growth and financial success of the Bank. As per