ICICI Bank 2003 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F85

Continued

notes to the consolidated financial statements

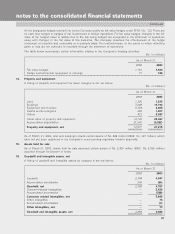

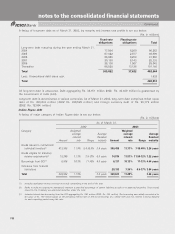

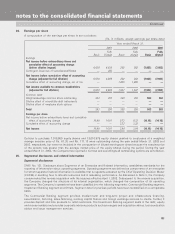

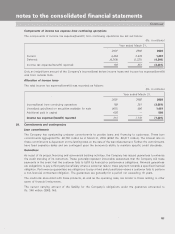

A reconciliation between the segment income and consolidated totals of the Company is set out below:

(Rs. in millions)

Total Income/(loss) before taxes Net income/

income andaccounting changes (loss)

Year ended March 31, Year ended March 31, Year ended March 31,

2001 2002 2003 2001 2002 2003 2001 2002 2003

Commercial banking 95,641 106,028 90,186 4,889 1,138 (11,272) 4,542 1,691 (7,852)

Investment banking 18,211 21,291 28,827 2,564 1,959 1,755 2,588 1,300 1,226

Others 1,659 2,789 2,874 116 (549) (1,527) (7) (343) (1,357)

Eliminations of the

acquiree (15,219) (29,308) —(750) (2,015) —(493) (1,101)

Other reconciling

adjustments (10,945) (13,785) (10,531) —— ———

Consolidated total 89,347 87,015 111,681 6,819 533 (11,044) 6,630 1,547 (7,983)

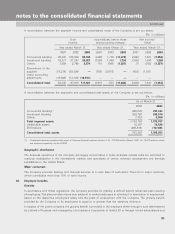

A reconciliation between the segments and consolidated total assets of the Company is set out below:

(Rs. in millions)

As of March 31,

2002 2003

Commercial Banking(1) 858,039 767,343

Investment Banking 268,726 398,574

Others 7,418 9,850

Total segment assets 1,134,183 1,175,767

Unallocable assets 15,397 16,826

Eliminations (406,218) (12,330)

Consolidated total assets 743,362 1,180,263

(1) Commercial banking includes retail assets of Personal financial services division of Rs. 172,208 million (March2002: Rs. 75,072 million), which

are reviewed separately by the CODM.

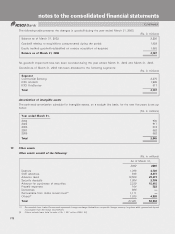

Geographic distribution

The business operations of the Company are largely concentrated in India. Activities outside India are restricted to

resource mobilization in the international markets and operations of certain software development and services

subsidiaries in the United States.

Major customers

The Company provides banking and financial services to a wide base of customers. There is no major customer,

which contributes more than 10% of total income.

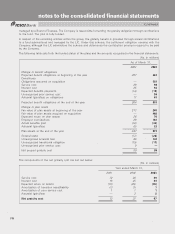

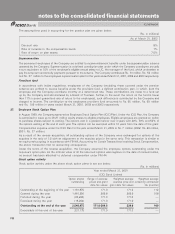

26. Employee benefits

Gratuity

In accordance with Indian regulations, the Company provides for gratuity, a defined benefit retirement plan covering

all employees. The plan provides a lump sum payment to vested employees at retirement or termination of employment

based on the respective employee’s salary and the years of employment with the Company. The gratuity benefit

provided by the Company to its employees is equal to or greater than the statutory minimum.

In respect of the parent company, the gratuity benefit is provided to the employee either through a fund administered

by a Board of Trustees and managed by Life Insurance Corporation of India (LIC) or through a fund administered and