ICICI Bank 2003 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion & Analysis

52

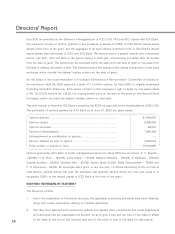

FINANCIALS AS PER INDIAN GAAP

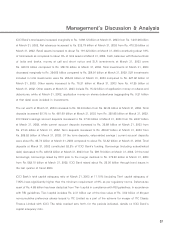

The Appointed Date for the merger of erstwhile ICICI Limited (ICICI) and two of its wholly-owned subsidiaries, ICICI

Personal Financial Services Limited (ICICI PFS) and ICICI Capital Services Limited (ICICI Capital) with ICICI Bank

(“the merger”) was March 30, 2002. Accordingly, ICICI Bank’s profit and loss account for fiscal 2003 includes the

full impact of the merger, whereas the Bank’s profit and loss account for fiscal 2002 included the results of

operations of ICICI, ICICI PFS and ICICI Capital for only two days i.e. March 30 and 31, 2002. ICICI Bank’s profit

and loss account for fiscal 2003 is therefore not comparable with the profit and loss account for fiscal 2002.

ICICI Bank’s operating profit (profit before provisions and tax, excluding gain on sale of ICICI Bank shares)

increased to Rs. 13.80 billion in fiscal 2003 as compared to Rs. 5.45 billion in fiscal 2002. During fiscal 2003,

the ICICI Bank Shares Trust divested 101.4 million shares of the Bank (transferred to the Trust by ICICI prior

to the merger in accordance with the Scheme of Amalgamation) to strategic and institutional investors,

resulting in capital gains of Rs. 11.91 billion for the Bank. During fiscal 2003, the Bank made total provisions

and write-offs (including accelerated/ additional provisions and write-offs against loans and investments, primarily

relating to ICICI’s portfolio) of Rs. 17.91 billion. On account of deferred tax asset arising out of provisions made

in fiscal 2003 and utilisation of fair value provisions against ICICI’s portfolio created at the time of the merger

and after taking into account the tax charge for the period, there was a net credit of Rs. 4.26 billion on account

of Income tax. Profit after tax for fiscal 2003 was Rs. 12.06 billion compared to Rs. 2.58 billion for fiscal 2002.

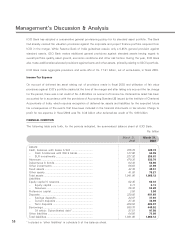

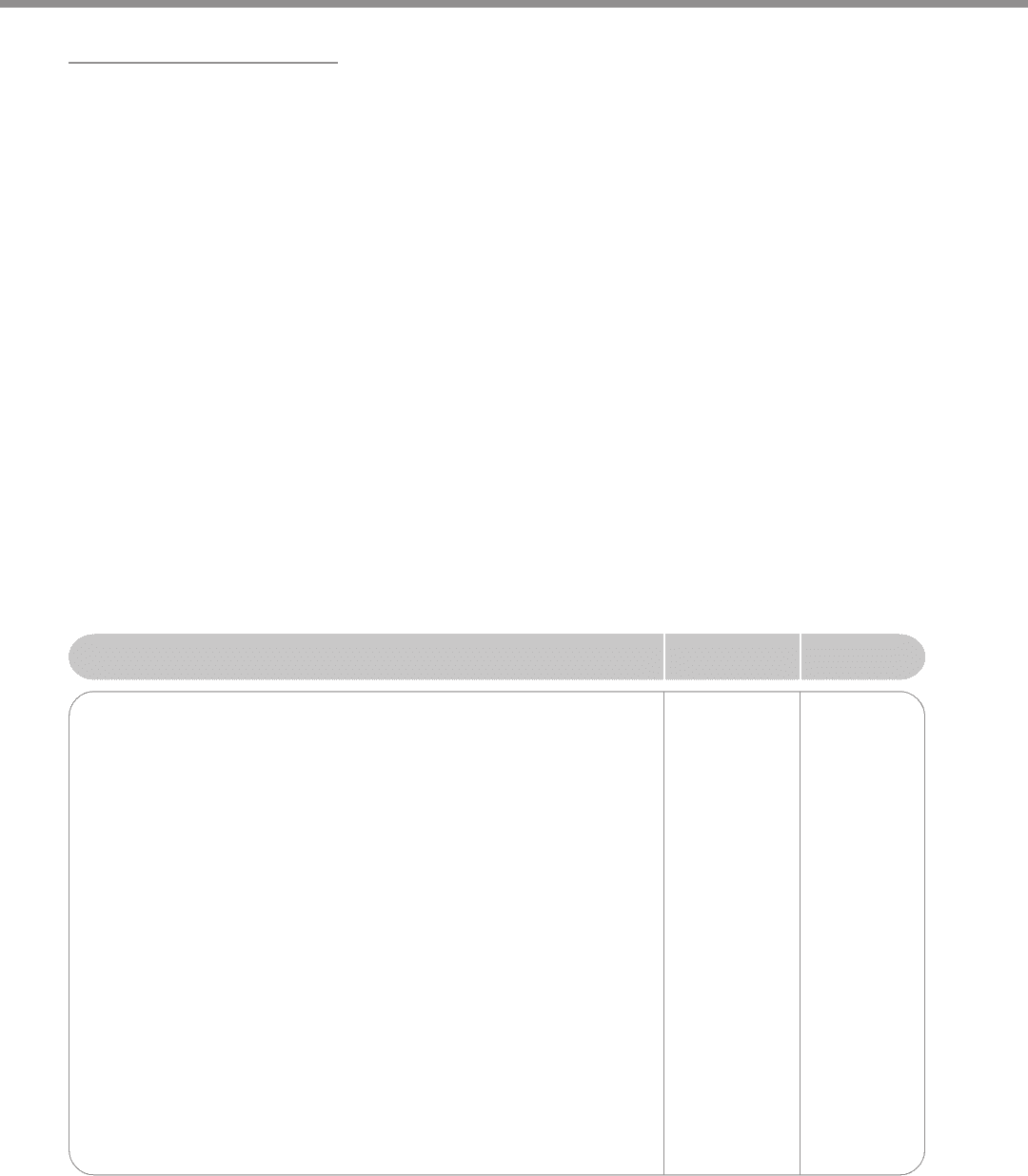

Operating Results Data

Rs. billion

Fiscal 2002 Fiscal 2003

Interest income ............................................................ 21.52 93.68

Interest expenditure ..................................................... 15.59 79.44

Net interest income ..................................................... 5.93 14.24

Non-interest income .................................................... 5.75 19.67

– Fee income1......................................................... 2.72 8.47

– Treasury income 2................................................. 2.92 4.47

– Lease income ....................................................... 0.11 5.37

– Others ................................................................... —1.36

Operating income ........................................................ 11.68 33.91

Operating expense ...................................................... 5.98 15.35

Direct Marketing Agent (DMA) expense3.................. 0.14 1.62

Lease depreciation....................................................... 0.11 3.14

Operating profit ........................................................... 5.45 13.80

Profit on sale of ICICI Bank shares ............................ —11.91

Provisions (including additional/accelerated provisions),

net of write-backs ....................................................... 2.55 17.91

Tax, net of deferred tax .............................................. 0.32 (4.26)

Profit after tax .............................................................. 2.58 12.06

1 Includes merchant foreign exchange income.

2 Excludes merchant foreign exchange income.

3 Other than on auto loans, which is reduced from the interest income.