ICICI Bank 2003 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F91

The Company has not recorded any compensation cost, as the exercise price was equal to the fair value of the

underlying equity shares on the grant date. As shares of ICICI OneSource Limited are not quoted on exchanges, the

fair value represents management’s best estimates considering all available factors.

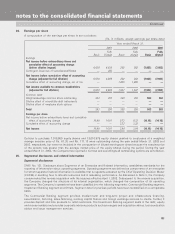

28. Income taxes

Components of deferred tax balances

The tax effects of temporary differences are reflected through a deferred taxasset/liability, which is included in the

balance sheet of the Company.

The components of the deferred tax balances are set out below:

(Rs. in millions)

As of March 31,

2002 2003

Deferred tax assets

Allowance for loan losses 12,263 16,228

Available for sale securities 2,141 1,044

Investments in trading securities 176 62

Unearned income 1,264 693

Capital loss carry forward 31 23

Business loss carry forward 175 219

Deposits —94

Other 676 574

16,726 18,937

Valuation allowance (226) (524)

Total deferred tax asset 16,500 18,413

Deferred tax liabilities

Property and equipment (9,416) (9,216)

Undistributed earnings of subsidiary and affiliates (875) (294)

Intangibles —(1,857)

Investment in trading securities —(39)

Long term debt —(666)

Available for sale securities —(20)

Others (58) (358)

Total deferred tax liability (10,349) (12,450)

Net deferred tax asset 6,151 5,963

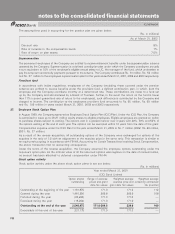

In assessing the realizability of deferred tax assets, management considers whether it is more likely than not that some

portion or all of the deferred tax assets will not be realized. The ultimate realization of the deferred tax asset is

dependent on the generation of future taxable income during the periods in which the temporary differences become

deductible. Management considers the scheduled reversal of the projected future taxable income, and tax planning

strategies in making this assessment. Based on the level of historical taxable income and projections for future taxable

incomes over the periods in which the deferred tax assets are deductible, management believes that it is more likely

than not that the Company will realize the benefits of those deductible differences. The amount of deferred tax assets

considered realizable, however could be reduced in the near term if estimates of future taxable income are reduced.

The Company would require taxable income of Rs. 21,266 million in the future periods to be able to fully realize the

benefit of net deferred asset recognized in these consolidated financial statements.

Continued

notes to the consolidated financial statements