ICICI Bank 2003 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F62

Continued

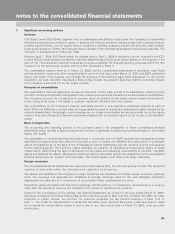

notes to the consolidated financial statements

The Company also includes in the allowances, provision for credit losses on its performing portfolio based on the

estimated probable losses inherent in the portfolio. The allowances on the performing portfolio are established after

considering historical and projected default rates and loss severities, internal risk rating and geographic, industry and

other environmental factors; and model imprecision.

The Company evaluates its impaired loan portfolio at the end of every period and loan balances which are deemed

irrecoverable are charged off against related allowances for credit losses.

Transfers and servicing of financial assets

In September 2000, the Financial Accounting Standards Board (FASB) issued Statement of Financial Accounting

Standards (SFAS) No. 140, Accounting for Transfers and Servicing of Financial Assets and Extinguishments of

Liabilities, a replacement of SFAS No. 125. The provisions of SFAS No. 140 relating to transfers and servicing of

financial assets are effective for transactions after March 31, 2001. The Company transfers commercial and consumer

loans through securitisation transactions. The transferred loans are de-recognized and gains/losses are recorded only

if the transfer qualifies as a sale under SFAS No. 140. Recourse and servicing obligations and put options written

are recorded as proceeds of the sale. Retained beneficial interests in the loans and servicing rights are measured

by allocating the carrying value of the loans between the assets sold and the retained interest, based on the relative

fair value at the date of the securitization. The fair values are determined using either financial models, quoted market

prices or sales of similar assets.

Loans held-for-sale

Loans originated for sale are classified as loans held-for-sale and are accounted for at the lower of cost or fair value.

Such loans are reported as other assets. Market value of such loans are determined at rates applicable to similar

loans.

Derivatives instruments and hedging activities

In June 1998, the FASB issued SFAS No. 133, Accounting for Derivative Instruments and Certain Hedging Activities.

In June 2000, the FASB issued SFAS No. 138, Accounting for Certain Derivative Instruments and Certain Hedging

Activity, an Amendment of SFAS No. 133. SFAS No. 133 and SFAS No. 138 require that all derivative instruments be

recorded on the balance sheet at their respective fair values. SFAS No. 133 and SFAS No. 138 are effective for

all fiscal quarters of all fiscal years beginning after June 30, 2000. On April 1, 2001, the Company adopted

SFAS No. 133 and SFAS No. 138 on a prospective basis.

Under SFAS No. 133, the Company may designate a derivative as either a hedge of the fair value of a recognized

fixed rate asset or liability or an unrecognized firm commitment (fair value hedge), a hedge of a forecasted transaction

or the variability of future cash flows of a floating rate asset or liability (cash flow hedge) or a foreign-currency fair

value or cash flow hedge (foreign currency hedge). All derivatives are recorded as assets or liabilities on the balance

sheet at their respective fair values with unrealized gains and losses recorded either in accumulated other

comprehensive income or in the statement of income, depending on the purpose for which the derivative is held.

Derivatives that do not meet the criteria for designation as a hedge under SFAS No. 133 at inception, or fail to meet

the criteria thereafter, are accounted for in other assets with changes in fair value recorded in the statement of

income.

Changes in the fair value of a derivative that is designated and qualifies as a fair value hedge along with the gain

or loss on the hedged asset or liability that is attributable to the hedged risk, are recorded in the statement of income

as other non-interest income. To the extent of the effectiveness of a hedge, changes in the fair value of a derivative

that is designated and qualifies as a cash flow hedge, are recorded in accumulated other comprehensive income,

net of tax. For all hedge relationships, ineffectiveness resulting from differences between the changes in fair value

or cash flows of the hedged item and changes in the fair value of the derivative are recognized in the statement

of income as other non-interest income.

At the inception of a hedge transaction, the Company formally documents the hedge relationship and the risk

management objective and strategy for undertaking the hedge. This process includes identification of the hedging

instrument, hedged item, risk being hedged and the methodology for measuring effectiveness. In addition, the

Company assesses, both at the inception of the hedge and on an ongoing quarterly basis, whether the derivative

used in the hedging transaction has been highly effective in offsetting changes in fair value or cash flows of the

hedged item, and whether the derivative is expected to continue to be highly effective.

The Company discontinues hedge accounting prospectively when either it is determined that the derivative is no

longer highly effective in offsetting changes in the fair value or cash flows of a hedged item; the derivative expires

or is sold, terminated or exercised; the derivative is de-designated because it is unlikely that a forecasted transaction

will occur; or management determines that designation of the derivative as a hedging instrument is no longer

appropriate.