ICICI Bank 2003 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F88

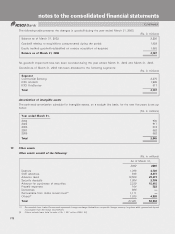

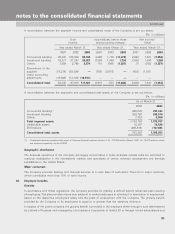

The assumptions used in accounting for the pension plan are given below:

(Rs. in millions)

As of March 31, 2003

Discount rate 8%

Rate of increase in the compensation levels 7%

Rate of return on plan assets 7.5%

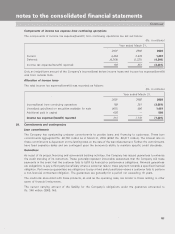

Superannuation

The permanent employees of the Company are entitled to receive retirement benefits under the superannuation scheme

operated by the Company. Superannuation is a defined contribution plan under which the Company contributes annually

a sum equivalent to 15% of the employee’s eligible annual salary to LIC, the manager of the fund, which undertakes to

pay the lump sum and annuity payments pursuant to the scheme. The Company contributed Rs.51 million, Rs.50million

and Rs.97million to the employees superannuation plan for the years ended March 31, 2001, 2002 and 2003 respectively.

Provident fund

In accordance with Indian regulations, employees of the Company (excluding those covered under the pension

scheme) are entitled to receive benefits under the provident fund, a defined contribution plan, in which, both the

employee and the Company contribute monthly at a determined rate. These contributions are made to a fund set

up by the Company and administered by a Board of Trustees. Further, in the event the return on the fund is lower

than 11% (current guaranteed rate of return to the employees), such difference is contributed by the Company and

charged to income. The contribution to the employees provident fund amounted to Rs. 55million, Rs. 89million

and Rs.106million in years ended March 31, 2001, 2002 and 2003 respectively.

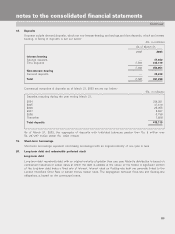

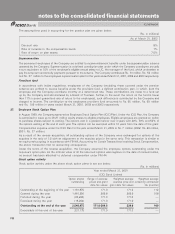

27. Employee Stock Option Plan

In August 1999, the Company approved an Employee Stock Option Plan (ICICI Plan). Under the ICICI Plan, the Company

is authorized to issue up to 39.27million equity shares to eligible employees. Eligible employees are granted an option

to purchase shares subject to vesting. The options vest in a graded manner over 3 years with 20%, 30% and 50% of

the options vesting at the end of each year. The options can be exercised within 10 years from the date of the grant.

Compensation expense under the ICICI Plan for the year ended March 31, 2003 is Rs. 7million (2002: Rs. 26 million,

2001: Rs. 37 million).

As a result of the reverse acquisition, all outstanding options of the Company were exchanged for options of the

acquiree in the ratio of 1:2 with an adjustment to the exercise price in the same ratio. This transaction is similar to

an equity restructuring. In accordance with FIN 44, Accounting for Certain Transactions involving Stock Compensation,

the above transaction had no accounting consequence.

Under the terms of the reverse acquisition, the Company assumed the employee options outstanding under the

acquiree’s option plan. As the intrinsic value of all the assumed options was negative on the date of consummation,

no amount has been allocated to deferred compensation under FIN 44.

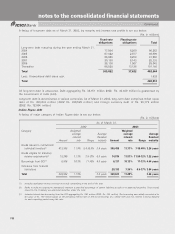

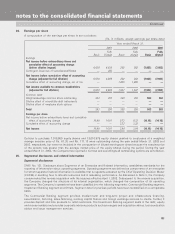

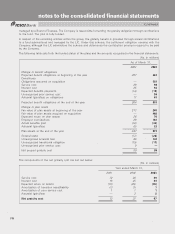

Stock option activity

Stock option activity under the above stock option plans is set out below:

(Rs. in millions)

Year ended March 31, 2001

ICICI Bank Limited

Option shares Range of exercise Weighted average Weighted average

outstanding prices and grant exercise price and remaining contractual

date fair values grant date fair values life (months)

Outstanding at the beginning of the year 1,161,875 171.0 171.0 112

Granted during the year 1,461,250 266.8 266.8 108

Forfeited during the year (60,200) 171.0 171.0 —

Exercised during the year (16,250) 171.0 171.0 —

Outstanding at the end of the year 2,546,675 171.0-266.8 226.0 109

Exercisable at the end of the year 231,175 171.0 171.0 —

Continued

notes to the consolidated financial statements